[ad_1]

Nvidia (NASDAQ: NVDA) stock has been hot over the short and long terms. Shares of the artificial intelligence (AI) chip leader have returned a whopping 241% in just one year, and 21,320% over the 10-year period through March 27. (For context, the S&P 500 index returned 34% and 242%, respectively, over these periods.)

Given these amazing performances, it’s natural to wonder if it’s too late to invest in Nvidia stock. A tool that can be useful in helping you make investing decisions is the outlining of where you think a company’s business will be in the future. Concentrate on the business; don’t focus on the stock. Over the longer term, the stock will perform well if the business is performing well.

In March 2020, I outlined where I thought Nvidia’s business would be in five years, or in March 2025. This article is a Year 4 update of those predictions.

1. CEO Jensen Huang will still be leading the company

Status at Year 4: On target.

In March 2020, I wrote that “as long as [Huang] stays healthy, the odds seem in favor of his still being at Nvidia’s helm in five years.” For context, co-founder and CEO Jensen Huang turned 61 earlier this year, according to public records.

Many CEOs who are very wealthy retire early. But as I said in 2020, “One only needs to listen to the company’s quarterly earnings calls to know that this is a guy who just loves his work.” Four years later, it’s still evident that Huang is intellectually energized by his work.

2. Nvidia will still be the leading supplier of graphics cards for computer gaming

Status at Year 4: On target — and Nvidia has increased its market share.

Here’s a snippet from my March 2020 article:

Nvidia dominates the market for discrete graphics processing units (GPUs) — the key component in graphics cards for desktop computer gaming. In the fourth quarter of 2019, the company controlled 68.9% of this market…

Nvidia has not only remained the leader in this category, but has increased its market share over the last four years. In the fourth quarter of 2023, it had an 80% share of the desktop discrete GPU market, compared with Advanced Micro Devices‘ 19% share, according to Jon Peddie Research. Intel, which entered this market in Q3 2022, had a 1% share.

3. The global gaming market will continue its robust growth

Status at Year 4: On target.

The global video gaming market grew at a compound annual growth rate (CAGR) of about 13% during the four-year period ended in 2023, according to Statista. Its market size was about $250 billion in 2023.

4. Nvidia’s GPUs will still be the gold standard for AI training

Status at Year 4: On target — and Nvidia has increased its market share.

In March 2020, I wrote, “Nvidia is sitting in the catbird seat when it comes to profiting from this humongous [artificial intelligence] growth trend.”

This topic is a huge one and deserves its own article. Suffice it to say here that Nvidia’s dominance in the overall AI chip market has increased over the last four years. Moreover, the market size itself has been rapidly growing, thanks in large part to the strong demand for chips to enable generative AI capabilities. Generative AI, which is the tech behind OpenAI’s ChatGPT chatbot, “enables users to quickly generate new content based on a variety of inputs,” in the words of Nvidia.

5. The legalization of driverless vehicles will turbocharge its auto platform’s growth

Status at Year 4: My timeline will likely be too optimistic.

This topic also deserves its own article. In short, I still fully believe in this prediction, but my timeline will likely be too optimistic, so I get at least a partial “ding” in this category. In March 2020, I wrote:

In 2025, fully autonomous vehicles should be legal — or very close to being so — across the United States. Nvidia is well positioned to majorly profit from [this event]. It’s inked partnerships with major players, [and I listed a bunch of auto industry companies].

6. The X factor

Status at Year 4: Achieved.

In March 2020, I wrote, “Nvidia is incredibly innovative, so there seems a great chance that the company will introduce at least one major new technology that takes nearly everyone by surprise.”

This prediction has already come true. Nvidia has launched a handful of major new technologies that have likely surprised almost everyone. One example is its Omniverse platform, which enables enterprises to create their own metaverses.

7. And Nvidia’s stock price in 2025?

Status at Year 4: Even with one year left to 2025, it seems safe to say that my “solidly outperform the market” prediction in the below quote will hold true.

Here’s what I wrote in March 2020:

It’s impossible to predict a company’s stock price in five years because so many unknowns … can have a huge influence on the market in general. That said, given the projections made in this article, I feel very comfortable predicting that Nvidia stock will solidly outperform the market over the next half decade. [Emphasis mine]

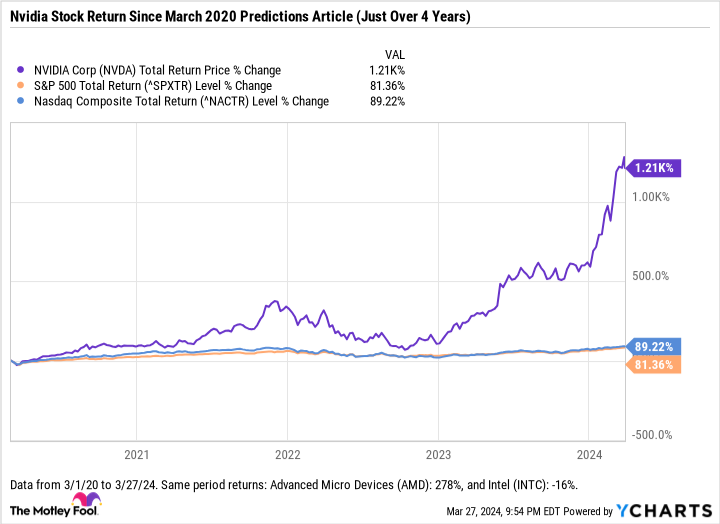

As the above chart shows, Nvidia stock has returned 1,210% in the just over four-year period since my March 2020 predictions article. The S&P 500 index and the tech-heavy Nasdaq Composite index have returned 81% and 89%, respectively, over this period.

Based upon this four-year update to my 2020 predictions, I feel confident that Nvidia stock will solidly outperform the market over the next five years.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of March 25, 2024

Beth McKenna has positions in Nvidia. The Motley Fool has positions in and recommends Advanced Micro Devices and Nvidia. The Motley Fool recommends Intel and recommends the following options: long January 2023 $57.50 calls on Intel, long January 2025 $45 calls on Intel, and short May 2024 $47 calls on Intel. The Motley Fool has a disclosure policy.

Where Will Nvidia Be in 5 Years? A Year 4 Update to My 2020 Predictions was originally published by The Motley Fool

[ad_2]