[ad_1]

It could take medical devices maker Masimo (MASI) months to regain its footing, an analyst said Tuesday as investors hammered MASI stock on a massive sales miss.

X

For the June quarter, Masimo preannounced $453 million to $457 million in sales. That’s far below forecasts for $503 million, according to FactSet. Masimo also cut its sales outlook for the year.

In response, MASI stock plummeted 21.2% near 115.90. In earlier trading on today’s stock market, the medical stock hit its lowest point in four years. The decline was even steeper in premarket action.

Masimo’s story is “messy,” BTIG analyst Marie Thibault said in a note to clients. It “may take months to regain footing,” she added.

“There are some bright spots, however,” she said. She noted the “prudent, cautious guidance cut” and the possibility some of Masimo’s issues are transient. She kept her buy rating on MASI stock, but slashed her price target to 153 from 200.

MASI Stock: Delays, Inventory Issues

The sales shortfall occurred across both of Masimo’s business. The company sees health care sales at $280 million to $282 million. It expects non-health care efforts to generate $173 million to $175 million in sales.

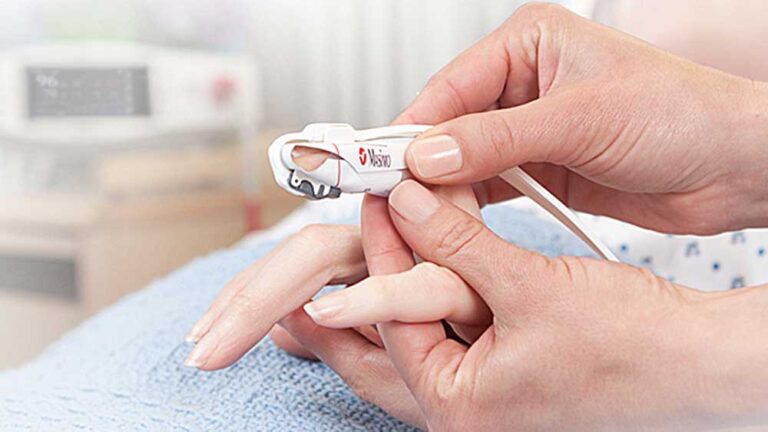

Hospitals often deploy Masimo’s technology. It sells noninvasive, remote-monitoring tools. But the June quarter featured low U.S. hospitalizations, an abnormally early and light flu season and delays in large orders. Some customers also relied on existing inventory instead of putting in new orders. Outside health care, Masimo called out a slowdown in high-end audio equipment.

“We believe that while Masimo’s health care challenges are mostly transitory, we believe that its non-health care challenges are longer term,” Needham analyst Mike Matson said in his note to clients. He cut his price target on MASI stock to 136 from 207, but kept his buy rating.

Meanwhile, BTIG’s Thibault says the issues seem to be specific to Masimo and shouldn’t indicate broad issues for the medical devices segment.

Still Evaluating, Company Says

Masimo cut the low end of its health care sales outlook to $1.3 billion from $1.45 billion.

“We are still evaluating the upper end of revenue guidance for the health care business, but it could be materially higher than the low end of our range, as we are still targeting our original guidance,” Masimo said in its news release.

The company also expects its non-health business to bring in $800 million to $850 million in sales. At the midpoint, that $155 million lower than the company’s prior outlook for MASI stock.

Follow Allison Gatlin on Twitter at @IBD_AGatlin.

YOU MAY ALSO LIKE:

Apellis Pharma Crashes After Safety Report Undercuts Its Newest Eye Drug

Novartis Puts Up Its Biggest Earnings Growth In Two Years; Shares Pop

Short-Term Trades Can Add Up To Big Profits. IBD’s SwingTrader Shows You How

Best Growth Stocks To Buy And Watch: See Updates To IBD Stock Lists

[ad_2]