[ad_1]

-

It’s a great time to be a stock picker with the majority of the market now represented by passive index funds.

-

More passive investors means active investors can capitalize on opportunities in the stock market.

-

Here’s how to beat the stock market in 2024, according to Bank of America’s Savita Subramanian.

The outlook for outperforming the stock market has never been brighter as the investing world transitions away from active investing and toward passive investing, according to Bank of America equity strategist Savita Subramanian.

In a recent note to clients, Subramanian highlighted that there are structural tailwinds for active investors in 2024 that should help them beat the stock market.

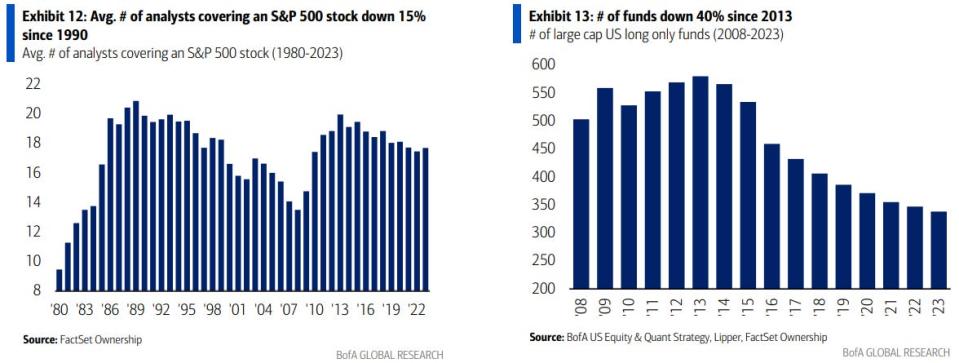

“A brain drain (20% fewer sell-side eyeballs) and asset drain (40% fewer funds) from active fundamental investing to passive and private equity suggest equity markets may be less efficient and thus offer more alpha potential,” Subramanian said.

Passive investing now represents 53% of US-domiciled assets under management, compared to 47% for active investing. Subramanian said passive’s share of the US stock market can rise even higher given that passive investing makes up 75% of Japan’s stock market.

Greenlight Capital founder David Einhorn is concerned about the ongoing rise of passive investing, saying this past week that it has “fundamentally broken” the stock market.

But Subramanian sees the rise of passive investing as an opportunity for active stock pickers.

Here’s how investors can take advantage of the rise in passive investments and beat the stock market in 2024, according to Bank of America.

“Pick stocks that act like stocks.”

“When we slimmed down our universe to stocks that ‘act like stocks’, fundamental signals dramatically improved,” Subramanian said.

In her analysis, Subramanian broke the S&P 500 into two groups: stocks that mostly traded on company-specific developments, and stocks that had less company-specific risk and traded more on the macro environment.

Subramanian found that fundamental investment strategies based on earnings growth, return on equity, and analyst outlook revisions would have generated more outperformance than the group of stocks that traded mostly on company-specific news.

“Consumer, Technology and Health Care companies are sectors where stock selection may be more fruitful, whereas sectors like Financials, Utilities or Commodities may be driven by macro cycles in rates, inflation, economic growth trends,” Subramanian said.

“Take the road less traveled.”

The stock market is highly efficient, but less-so for companies that receive less research coverage from Wall Street.

And less efficient stocks have more outsize opportunities and risks compared to a company that is tracked and owned by nearly everyone on Wall Street. That suggests investors should focus their investments on less popular companies.

“When we limited our universe to stocks with lower sell-side analyst coverage – arguably a less efficient universe – fundamental factors’ performance dramatically improved,” Subramanian said.

“Extend your time horizons.”

With the rise of zero-day options, investors are getting more and more short-sighted, trying to make a quick buck. But that’s not a sustainable practice when it comes to investing, especially if you’re trying to outperform the broader market.

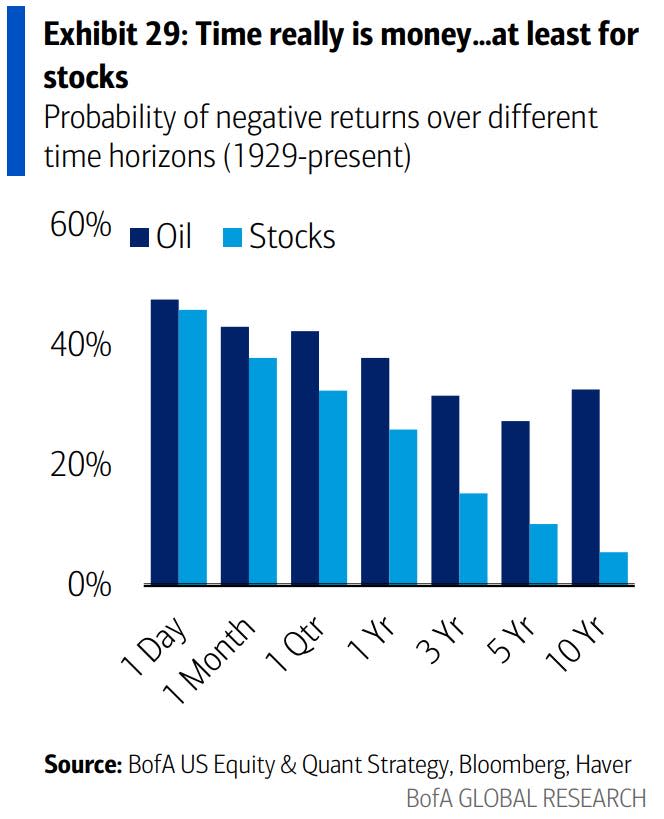

“As investors have collectively moved to the short-term – we remind ourselves that the likelihood of losing money in the S&P 500 drops from a coin flip to a 2-sigma event by extending one’s holding period from a day to a decade,” Subramanian said.

Time is on an investor’s side, as long as they take advantage of it.

Read the original article on Business Insider

[ad_2]