[ad_1]

“A few good ideas is all you need. And when you find the few, you have to act aggressively. That’s the Munger system.”-Charlie Munger

Boom! $150,000 lands in your pocket out of nowhere.

What would you do? Buy a new car? Embark on the vacation of a lifetime? Renovate your home?

If I were to find myself in such a hypothetical scenario, I know what I would do: I’d follow Charlie Munger’s advice and invest it — perhaps $50,000 each into three stocks. Maybe it would go something like this:

1. Visa

First up is Visa (NYSE: V), the world’s largest payment-processing company.

Notice that I called Visa a payment-processing company rather than a credit card company. That’s because Visa doesn’t issue credit or debit cards. Indeed, contrary to popular belief, Visa doesn’t offer customers credit, set rates, or charge fees. Instead, Visa partners with financial institutions like banks and credit unions by offering access to the Visa-branded payment network (for a fee).

That’s a key distinction, as Visa has no credit risk. It also means the company’s revenue is largely tied to the volume of payments and transactions on its network.

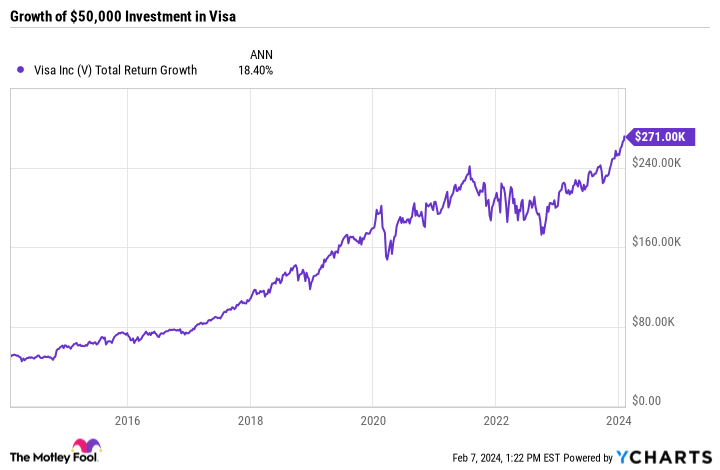

At any rate, Visa’s no-nonsense business model has delivered exceptional shareholder gains. Over the last decade, Visa’s stock has generated an annualized total return (price appreciation plus dividend payments) of 18.4%.

That means $50,000 invested in Visa 10 years ago would be worth $271,000 today — not too shabby. However, I also have my eye on some spicier picks.

2. CrowdStrike

Next up is a younger, faster-growing company. It’s CrowdStrike (NASDAQ: CRWD), a leader in AI-driven cybersecurity solutions. While I value Visa for its steady growth, CrowdStrike is all about potential.

The company is growing revenue at a 35% year-over-year rate as of its most recent quarter (the three months ending on Oct. 31, 2023). Moreover, the overall cybersecurity market that CrowdStrike aims to satisfy is growing by leaps and bounds.

In short, that’s because cybercrime is booming. Hackers — seeking money, political retribution, or chaos — are running amok right now. Large organizations, ranging from large-cap corporations to governments and non-profits, are all scrambling to protect their networks, harden their defenses, and safeguard their data.

More to the point, some analysts expect the cybersecurity market to grow by 50% to $274 billion by 2028 — presenting a significant opportunity for cybersecurity companies like CrowdStrike.

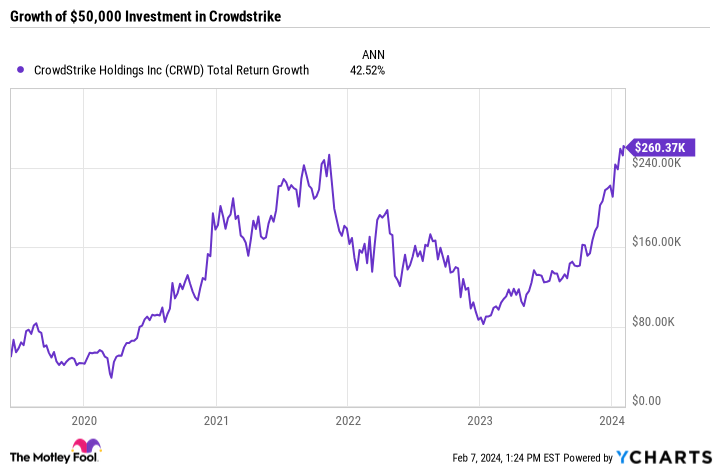

At any rate, CrowdStrike’s stock has rewarded investors since its debut in 2019. Its total return since then is more than 423% or almost 43% annually.

In other words, $50,000 invested in CrowdStrike’s Initial Public Offering (IPO) on June 12, 2019, would be worth $260,000 as of the time of this writing.

That’s an impressive return, and if CrowdStrike shares grow at that rate over the next decade, my hypothetical portfolio would be well on its way to $1 million.

However, I still have one final pick to make.

3. Nvidia

Last, we arrive at Nvidia (NASDAQ: NVDA). In my opinion, no other stock can match Nvidia’s combination of actual results and potential.

As for the results, they’re plain to see. Meta Platforms, Microsoft, Amazon, Tesla, and many others are buying all the Nvidia AI chips they can get their hands on. And yet, the demand seems insatiable because the world can’t get enough of artificial intelligence (AI).

For his part, Nvidia Chief Executive Officer (CEO) Jensen Huang put it this way: “For the very first time, because of generative AI, computer technology is going to impact literally every single industry and every single country.”

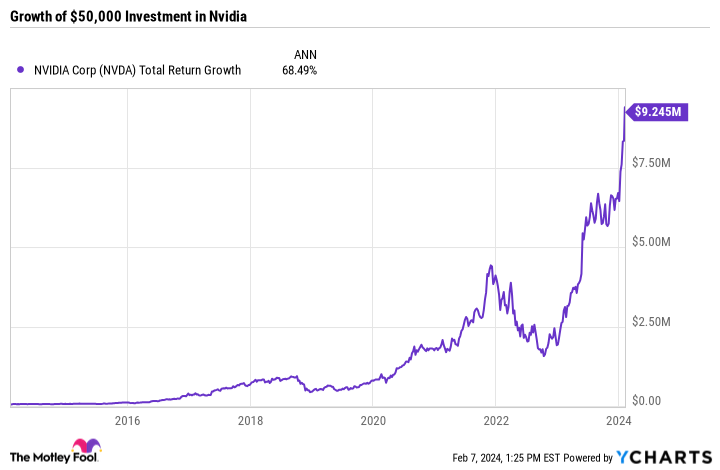

So, given the massive demand for AI chips, it should come as no surprise that Nvidia has been one of the best stocks to own over the last 10 years.

Indeed, a $50,000 investment made in Nvidia shares 10 years ago would now be worth an astronomical $9.2 million as of this writing.

It’s hard to believe that a similar return is possible for Nvidia shares over the next 10 years, but no one really knows.

One thing is certain: The world is desperate for more AI products, which means more AI chips. Nvidia is currently the market leader, but others, like AMD and Intel, want to catch up. Moreover, some big tech names like Alphabet and Apple are developing their own AI chips, given the lucrative nature of the market.

Still, Nvidia is well positioned to benefit from the surge in AI demand for many years. And that’s why it gains the final place in my hypothetical portfolio.

Should you invest $1,000 in Visa right now?

Before you buy stock in Visa, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Visa wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of February 5, 2024

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Jake Lerch has positions in Alphabet, Amazon, CrowdStrike, Nvidia, Tesla, and Visa. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Amazon, Apple, CrowdStrike, Meta Platforms, Microsoft, Nvidia, Tesla, and Visa. The Motley Fool recommends Intel and recommends the following options: long January 2023 $57.50 calls on Intel, long January 2025 $45 calls on Intel, and short February 2024 $47 calls on Intel. The Motley Fool has a disclosure policy.

Want $1 Million in Retirement? Invest $50,000 in These 3 Stocks and Wait a Decade was originally published by The Motley Fool

[ad_2]