[ad_1]

Who doesn’t love a bargain? Buying quality for a low price is one of the thrills of the market system – and that applies to stock markets as well. The trick is knowing which rock-bottom stocks are the right ones to buy.

Plenty of stocks are priced low, and bargain-hunting investors need to find the ones whose fundamentals are sound. The sheer volume of stocks, and the reams of data they produce, makes that difficult – but Wall Street analysts make their living by taking deep dives behind the scenes of the stock market, and their recommendations are always worth a read.

Using the analyst reviews as a guide and backing them up with the latest data from TipRanks, we’ve picked out two stocks that should attract the interest of bargain-minded investors. Both stocks hold ‘Strong Buy’ ratings from the analysts, and both are showing significant losses over the past year, on the order of 50% or more. Let’s take a closer look.

ADTRAN, Inc. (ADTN)

Let’s start with ADTRAN, a company based in Alabama that offers ‘open, disaggregated networking and communications solutions’ on a global scale. ADTRAN’s product range encompasses voice, data, video, and internet communications solutions, all adaptable to existing network infrastructures. Collaborating with service providers worldwide, the company facilitates scalable management of services, linking individuals, locations, and devices.

ADTRAN maintains offices in the UK, Europe, the Middle East, and Australia, catering to millions of customers in governmental and private sectors. The company’s portfolio covers network infrastructure, fiber access, aggregation, open optical networking, residential and business solutions, cloud software, as well as services and support.

Shares in ADTRAN are down 59% so far this year, with a series of disappointing earnings results not helping its case, as happened in the recently released Q2 print. The 2Q23 numbers showed a top line of $327.4 million, for a 90% y/y increase – but missing the forecast by $2.3 million. Looking ahead, ADTRAN anticipates 3Q23 revenue to range between $275 million and $305 million, which lags behind the consensus estimate of $352.5 million.

This global telecom firm has caught the attention of Rosenblatt’s 5-star analyst Mike Genovese, who defends the company, and points out in his recent note several reasons why investors should consider owning the stock. Laying out the case, Genovese writes: “1) The stock is inexpensive at under 0.5x EV-to-2024 sales. 2) The company has won more Huawei replacement business than any other (six EMEA Tier 1 wins) and the revenue growth from these wins is still ahead. 3) We expect 2024 to be a good year, and think Adtran will likely grow revenues by double-digits. 4) Industry comps, and inventory correction pressures, should become much easier in 4Q23, compared to 3Q23, and continue to improve in early 2024. In other words, we think 3Q23 is the bottom for the industry.”

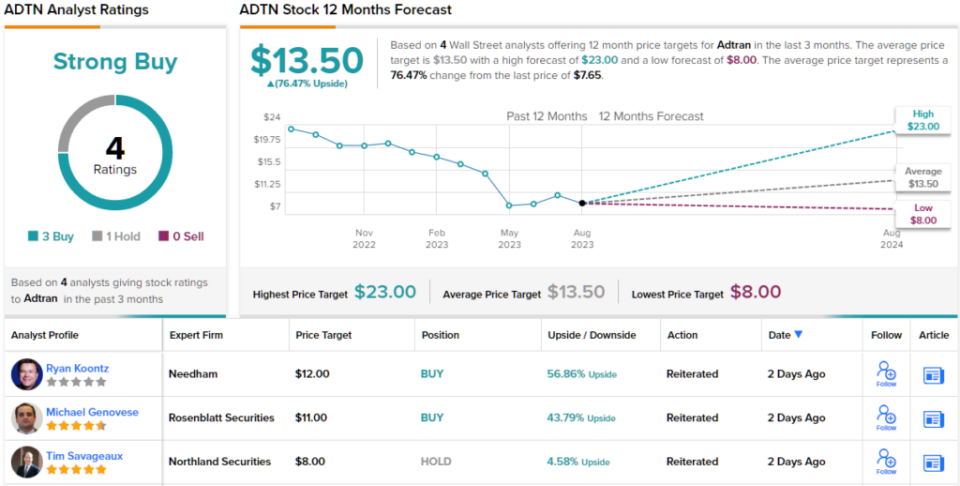

Tracking forward from these comments, Genovese rates ADTN shares as a Buy, and his price target, of $11, implies a one-year upside potential of ~44%. (To watch Genovese’s track record, click here)

Overall, there are 4 recent analyst reviews on ADTN shares, breaking down 3 to 1 favoring Buys over Holds, to make the Strong Buy consensus rating. The shares have a current trading price of $7.65, and the $13.50 average price target suggests the stock will gain ~76% in the next 12 months. As an added bonus, ADTRAN pays a forward annual dividend yield of 4.7%. (See ADTRAN stock forecast)

IGM Biosciences (IGMS)

The second beaten-down stock we’re looking at is a biomedical research firm, IGM Biosciences. This company is working in the field of antibody medicines, using IgM antibodies as the starting point in its development therapeutic agents designed to surpass the shortcomings of existing IgG antibody medicines. The company has used IgM technology to create several ‘super antibodies,’ which are forming the base of a new class of advanced drug candidates.

IGM has put together a proprietary pipeline with seven active research tracks. Of these, one is still in preclinical development, but the other six have moved to Phase 1 clinical trials. These pipeline research tracks include both monotherapy and combination therapy programs, and target a variety of cancers. The leading drug candidate, aplitabart, is the subject of three trials, in combination with other anti-cancer drugs, against colorectal cancer, acute myeloid leukemia, and solid tumors.

IGM reported several positive steps in its pipeline programs. Prominent among these was the rehash of positive clinical data from the Phase 1 trial of aplitabart + Folfiri in the treatment of colorectal cancer. The company reported that 51 patients on the drug combination showed ‘promising activity in terms of progression-free survival.’

Furthermore, the company’s drug candidate imvotamab, a potential treatment for autoimmune diseases, received FDA clearance for two Phase 1b clinical trials. The first will target severe systemic lupus erythematosus (SLE) while the second will focus on severe rheumatoid arthritis (RA). Both trials are expected to initiate during 3Q23.

However, despite all this activity, shares in IGMS are down 54% so far this year. That brings the price down, and Stifel analyst Stephen Willey sees that as a buying opportunity. In his comments, the 5-star analyst notes the ongoing progress of aplitabart, before coming to a bullish conclusion:

“We continue to believe the biology of simultaneously modulating extrinsic/intrinsic apoptosis signaling pathways has much-broader applications beyond mCRC and Aplitabart remains the centerpiece of our longer-term estimates/valuation… We believe management’s disclosure of incremental patient efficacy/safety data from the single-arm, dose-expansion cohorts evaluating the combination of Aplitabart 3mg/kg + FOLFIRI ± bevacizumab (Bev) in mostly 3L+ mCRC patients is directionally-positive and further-confirms our confidence in the underlying biological hypothesis (simultaneous extrinsic/intrinsic apoptosis pathway modulation) and longer-term path forward.”

“Multiple additional disclosures/updates expected from this development program by YE23 now provide important near-term catalysts for what we believe remains an undervalued/underappreciated stock,” Willey summed up.

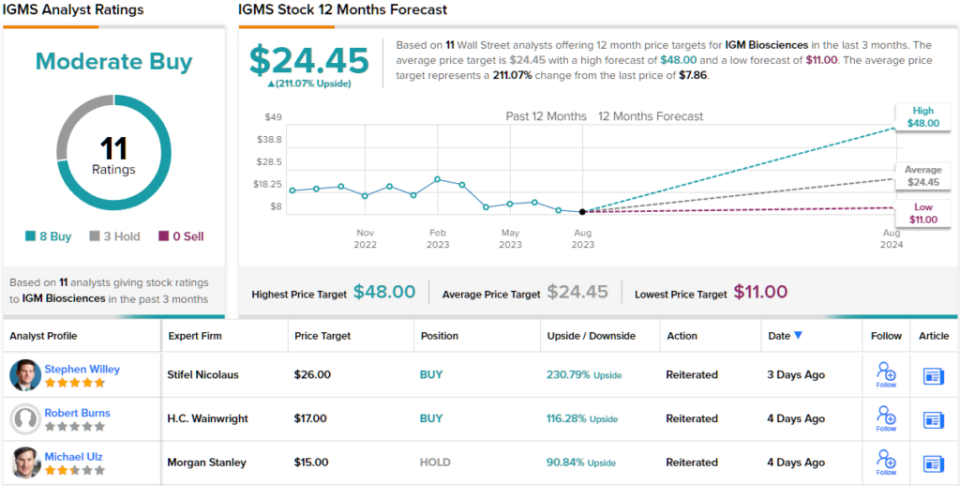

To this end, Willey rates IGMS shares as a Buy, and his target price of $26 shows his confidence in a robust 230% gain in the coming year. (To watch Willey’s track record, click here)

Overall, IGM’s 11 recent analyst reviews, including 8 Buys to 3 Holds, support the stock’s Buy rating, while the average price target of $24.45 and trading price of $7.86 combine to suggest a 211% upside potential on the one-year horizon. (See IGM stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

[ad_2]