[ad_1]

(Bloomberg) — Federal Reserve Chair Jerome Powell’s sign of higher-for-longer rates of interest coursed by markets Monday, sinking shares and fairness futures and lifting two-year Treasury yields to ranges final seen in 2007.

Most Learn from Bloomberg

An Asian share index fell greater than 2%, essentially the most in over two months. Losses on Nasdaq 100 and European futures have been at the very least 1.5%. China and Hong Kong declines have been smaller amid progress on the US-China delisting spat.

The Bloomberg Greenback Spot Index pushed towards the document hit final month as traders sought a haven from spiking volatility. Commodity-linked currencies in addition to the yen, the pound and the offshore yuan have been below stress.

Bonds offered off amid a deepening inversion of the US yield curve that underscores expectations of a recession below tightening financial coverage. The US two-year yield, delicate to expectations round Fed coverage, hit 3.45%

Powell in his tackle final week on the Fed’s Jackson Gap symposium flagged the doubtless want for restrictive financial coverage for a while to curb excessive inflation and cautioned in opposition to loosening financial situations prematurely. He additionally warned of the potential for financial ache for households and companies.

These feedback distinction with bets for reductions in US borrowing prices subsequent yr as development slows. The locus for a lot of the investor angst is the equities market, additional undoing a bounce in international shares from the bear-market lows of mid-June. Different dangers embody China’s slowdown and Europe’s vitality disaster.

Powell signaled “as soon as they get to regardless of the remaining hike is, they’re going to remain there for some time,” Charles Schwab & Co. Chief Funding Strategist Liz Ann Sonders mentioned on Bloomberg Tv. “The market had bother digesting that.”

Bitcoin broke under the $20,000 degree some view as a marker of a deeper slide in investor sentiment. Gold retreated however oil made positive aspects as merchants evaluated dangers to crude provides.

The relative resilience in China’s inventory market might replicate optimism a couple of preliminary deal between Beijing and Washington to ease a dispute over reviewing audits of Chinese language companies. An settlement is required to avert the delisting of about 200 Chinese language corporations from US exchanges.

Listed here are some key occasions to look at this week:

-

US client confidence, Tuesday

-

New York Fed President John Williams as a result of communicate, Tuesday

-

ECB Governing Council members as a result of communicate at occasion Tuesday by Sept. 2

-

China PMI, Wednesday

-

Euro-area CPI, Wednesday

-

Russia’s Gazprom set to halt Nord Stream pipeline fuel flows for 3 days of upkeep, Wednesday

-

Cleveland Fed President Loretta Mester as a result of communicate, Wednesday

-

China Caixin manufacturing PMI, Thursday

-

US nonfarm payrolls, Friday

-

UK management poll closes Friday. Winner introduced Sept. 5

Among the fundamental strikes in markets:

Shares

-

S&P 500 futures fell 1.1% as of 10:47 a.m. in Tokyo. The S&P 500 fell 3.4%

-

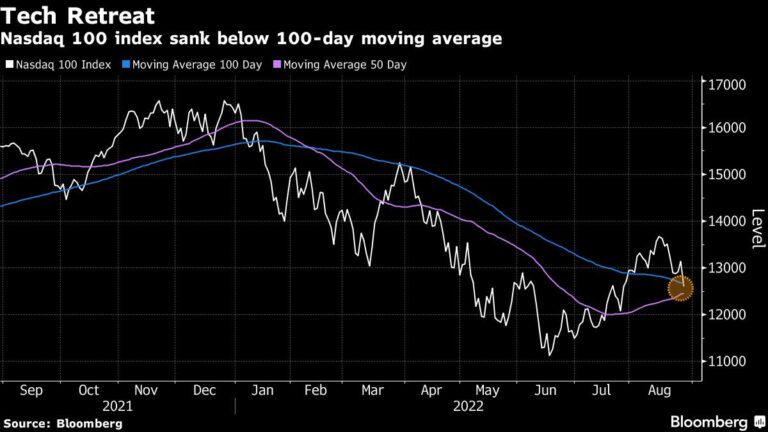

Nasdaq 100 futures dropped 1.5%. The Nasdaq 100 shed 4.1%

-

Japan’s Topix index fell 2.1%

-

Australia’s S&P/ASX 200 index misplaced 2%

-

South Korea’s Kospi dropped 2.3%

-

Hong Kong’s Hold Seng index retreated 1%

-

China’s Shanghai Composite index was down 0.4%

-

Euro Stoxx 50 futures fell 1.7%

Currencies

-

The Bloomberg Greenback Spot Index rose 0.5%

-

The euro was at $0.9927, down 0.4%

-

The Japanese yen was at 138.54 per greenback, down 0.6%

-

The offshore yuan was at 6.9258 per greenback, down 0.5%

Bonds

Commodities

-

West Texas Intermediate crude was at $93.74 a barrel, up 0.7%

-

Gold was at $1,726.88 an oz., down 0.6%

Most Learn from Bloomberg Businessweek

©2022 Bloomberg L.P.

[ad_2]