-

Investors have been piling into riskier, leveraged stock-market bets in recent weeks, Vanda Research said.

-

Those increased inflows come as the stock market has made new records.

-

Strategists said investors may be trying to make their capital work harder via leverage.

The stock market has soared to records in the first three months of the year, and retail traders have been increasingly leaning into that momentum with riskier bets.

According to Vanda Research, individual investors’ use of leverage has steadily ramped up over recent weeks.

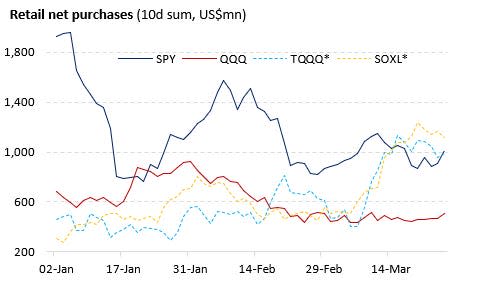

As the chart below illustrates, retail investors have dialed back purchases of broader market ETFs like SPY and QQQ — which track the S&P 500 and Nasdaq — while increasing exposure to triple-leveraged funds right as stocks are hitting all-time highs.

The trend comes as major averages have enjoyed strong first-quarter gains, with the Dow Jones Industrial Average, up 4.91% year-to-date and the S&P 500, and the Nasdaq Composite up 10.1% and 10.59%.

Risk-on bets across markets including crypto and meme stocks are on the rise again, this time bucking the trend of high interest rates that took the air out of those trades two years ago when the Federal Reserve started tightening monetary policy.

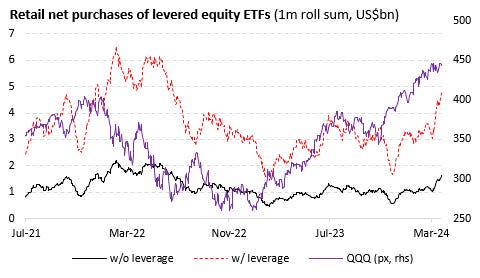

“If we then expand the levered ETF pool to a few more heavily-traded funds, we see that retail inflows (adjusted for leverage) have now easily cleared highs seen during the last AI-fuelled rally in May-July ’23,” Vanda strategists wrote this week.

The chart below depicts how retail net purchases of levered ETFs have ramped up in February and March 2024. The data is based on the largest 22 levered ETFs in the US, as of March 26.

Another potential driver, meanwhile, is that after about two years, the average retail portfolio is finally out of the red following the brutal bear market of 2022. Now that the focus is on driving gains rather than recouping losses, traders may feel more confident taking on higher risk, Vanda said.

The analysts went on to note that they expect retail investors to lean into contrarian bets, buying dips or selling into rallies. They also say that retail is diversifying away from the top gainers like the Magnificent Seven and into other stocks, with data suggesting the cohort is looking to get in early on any increased breadth in stock-market gains.

Read the original article on Business Insider