[ad_1]

What should we make of the markets today? That’s the question on the minds of every market and economic expert out there – and it’s a challenging one.

Inflation has dropped to 3% annually, and the labor market is hot. Stocks are up, indicating that investors have priced in the risk of potential recession. However, this leads to a problem highlighted by Piper Sandler’s chief strategist, Michael Kantrowitz. He points out that estimates for forward earnings are not keeping up with the positive sentiment. Kantrowitz adds that as inflation falls, pricing power weakens, and so does forward revenue growth. As a result, earnings expectations are now souring.

“We still believe the second half of 2023 will show the lingering effects of monetary policy, particularly in earnings and labor, leading to negative returns in H2,” Kantrowitz says, and goes to add that even if a full-blown recession does not hit, “a weak growth outlook and already-high price multiples could mean poor stock market performance…”

In such a scenario, it becomes crucial to adopt a defensive position. One effective way to navigate through uncertain times is by embracing the tried-and-true strategy of investing in high-yielding dividend stocks. By doing so, investors can secure a consistent and reliable income stream, regardless of whether the overall stock market experiences gains or losses.

Against this backdrop, Piper Sandler analysts have identified two potential opportunities, one of which boasts a sky-high 13% yield. Let’s take a closer look.

Annaly Capital Management (NLY)

We’ll start with Annaly Capital Management, a mortgage real estate investment trust, or mREIT. Real estate investment trusts are typically dividend champions, required by tax regulations to directly return profits to shareholders – and Annaly can fall back on a profitable business to support those returns through its dividend payments.

Annaly owns a portfolio of mortgages and mortgage-backed securities, with $86 billion in total assets and $12 billion in permanent capital. The company’s portfolio is composed of securities, loans, and equities in the mortgage finance market.

This is a leading company in the mREIT segment, but it did show mixed results in the last quarterly financial report. That report, for 1Q23, showed a top line of $19.46 million, a total that was down some 96% year-over-year. The bottom line, however, was sound profit, of 81 cents per share in non-GAAP terms – and 6 cents per share ahead of the estimates.

In addition to its mixed revenues and earnings, Annaly finished Q1 with $1.79 billion in cash and other liquid assets on hand, a figure that was up significantly from the $955 million reported in 1Q22. The cash reserves are of direct interest to dividend investors, as they provide support for the payments.

And they are substantial payments. Annaly declared its Q2 dividend payment in June, and the payment went out on June 29. The dividend was set at 65 cents per common share, and the annualized rate of $2.60 per common share gives a yield of 13%.

Analyst Crispin Love, in his coverage of Annaly for Piper Sandler, takes a bullish stance, based in part on the strength of mREITs generally, and he says of Annaly, “We continue to believe it is an attractive time to invest in agency mortgage REITs as spreads remain wide, interest rate volatility should subside as the Fed reaches the terminal rate, and the valuation is attractive at a discount to tangible book value. In addition, Annaly is able to take advantage of its differentiated model that includes residential credit and mortgage servicing rights strategies in addition to agency.”

“Based on management commentary as well as our core earnings forecast, we expect the dividend to remain stable with core earnings coverage through the end of 2024 along with less interest rate volatility as the Fed reaches the terminal rate,” Love added.

These comments back up Love’s rating on Annaly stock, an Overweight (i.e. Buy), and his $21.50 price target shows his belief in an upside of 6% for the shares. Based on the current dividend yield and the expected price appreciation, the stock has ~19% potential total return profile. (To watch Love’s track record, click here)

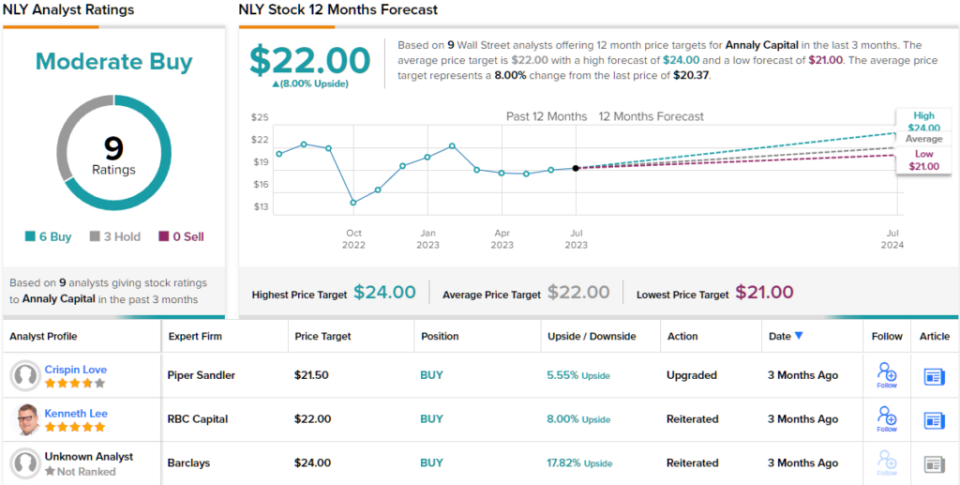

Overall, the 9 recent analyst reviews on this stock break down 6 to 3 in favor of Buys over Holds, for a Moderate Buy consensus rating. The shares are priced at $20.37 and have an average price target of $22, implying a gain of 8% in the next 12 months. (See NLY stock forecast)

V.F. Corporation (VFC)

The next dividend stock we’re looking at is V.F. Corporation, a leader in the global apparel and footwear industry. The company, formerly known as Vanity Fair Mills until 1969, was founded in 1899 and operates a dozen brands from its headquarters in Colorado. VF’s portfolio includes some of the most well-known names in the Outdoor, Active, and Work apparel niches, such as Vans, The North Face, and Timberland, among others. Four of VF’s brands — JanSport, Eastpak, Timberland, and The North Face — dominate the backpack market in the United States.

VF shifted to its current incarnation as an outdoor, activewear-oriented firm in 2018, after it spun off its jeans and outlet stores as a separate entity. VF is now the country’s leader in active lifestyle clothing brands. The company’s revenues and earnings show a clear seasonal pattern, with the highest sales and income coming from August through January, in VF’s fiscal second and third quarters. While VF has a leading position in its markets, its stock has fallen by 27% so far this year.

The decline in share price occurred despite VF’s revenues and earnings surpassing expectations in the company’s most recent fiscal quarter, 4Q23. VF reported $2.74 billion in revenue, a 3% decline compared to the previous year, but $20 million higher than expected. The bottom line earnings, measured by non-GAAP figures, reached an EPS of 17 cents per share, surpassing the forecast of 14 cents by 3 cents. Among VF’s brands, The North Face demonstrated the strongest performance, with a 12% year-on-year increase in revenue.

On the dividend, VF made its last declaration in May for a June 20 payout, announcing a 30-cent payment per common share. When projected forward, this dividend yields $1.20 per share and gives a yield of 6.25%, well above average and more than double the current annualized inflation rate.

For Piper Sandler analyst Abbie Zvejnieks, VF’s brand portfolio forms the company’s underlying strength. She writes, “We believe negative catalysts at VFC are largely behind us, and the company is entering into FY24 as a year of progress with turnaround initiatives underway. We are encouraged by continued momentum at The North Face, green shoots on new product at Vans, and Dickies and Supreme growth accelerating. Tight expense controls as well as promotional and supply chain improvements should drive margin expansion while VFC invests in product innovation and marketing, and we remain confident in the FCF generation opportunity of these large powerful brands… With a strong portfolio of brands, we think VFC is the best turnaround story in our space.”

Unsurprisingly, Zvejnieks rates VFC shares an Overweight (i.e. Buy), with a $29 price target that implies a one-year potential upside of 51%. (To watch Zvejnieks’ track record, click here)

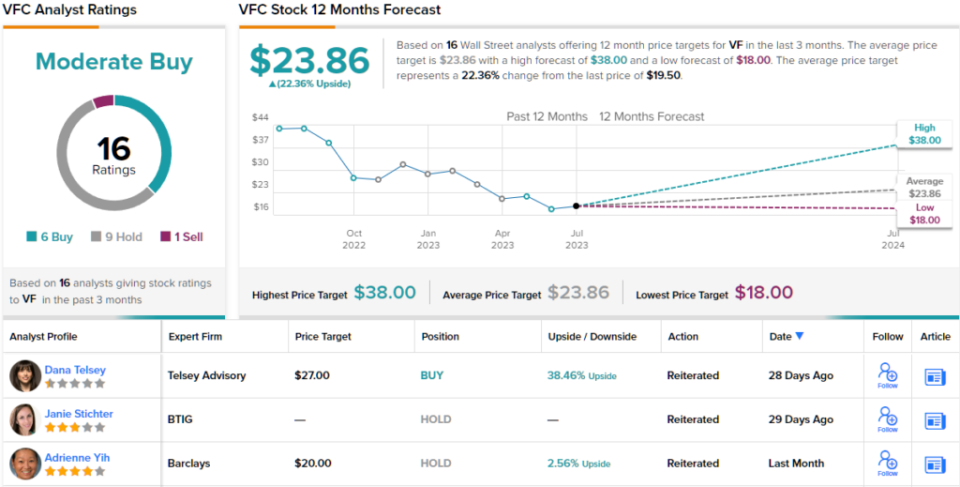

Looking at the consensus breakdown, there have been 6 Buys, 9 Holds, and 1 Sell published in the last three months. As a result, VFC gets a Moderate Buy consensus rating. The shares are trading for $19.50, and the average price target of $23.86 suggests it has ~22% upside for the coming year. (See VFC stock forecast)

To find good ideas for dividend stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

[ad_2]