[ad_1]

(Bloomberg) — Within the aluminum trade, closing a smelter is an agonizing resolution. As soon as energy is minimize and the manufacturing “pots” settle again to room temperature, it may possibly take many months and tens of thousands and thousands of {dollars} to carry them again on-line.

But Norsk Hydro ASA is making ready this month to do precisely that at an enormous plant in Slovakia. And it’s not the one one — European manufacturing has dropped to the bottom ranges for the reason that Nineteen Seventies and trade insiders say the escalating vitality disaster is now threatening to create an extinction occasion throughout giant swathes of the area’s aluminum manufacturing.

The reason lies in aluminum’s nickname: “congealed electrical energy.” The steel — utilized in an enormous vary of merchandise, from automobile frames and soda cans to ballistic missiles — is produced by heating uncooked supplies till they dissolve, after which working an electrical present by means of the pot, making it massively energy intensive. One ton of aluminum requires about 15 megawatt-hours of electrical energy, sufficient to energy 5 properties in Germany for a 12 months.

Some smelters are protected by authorities subsidies, long-term electrical energy offers or entry to their very own renewable energy, however the remaining face an unsure future.

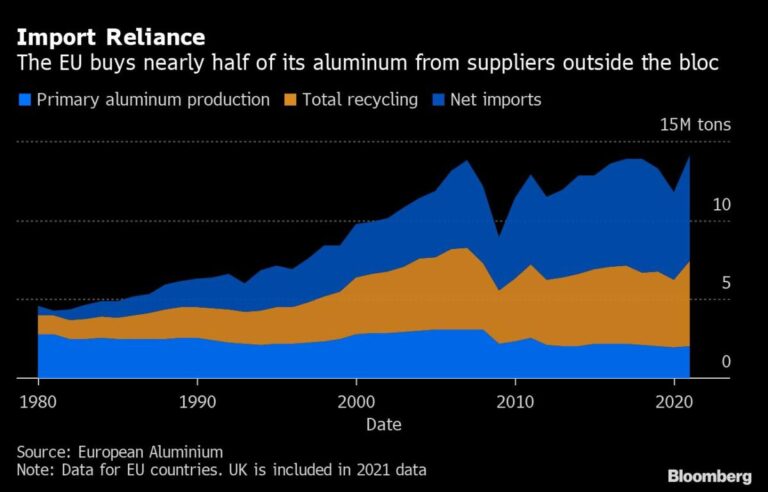

As manufacturing drops, the lots of of European producers that flip steel into elements for German vehicles or French airplanes are left more and more reliant on imports that might get costlier. Some patrons are additionally attempting to keep away from steel from Russia, which is often an enormous provider to Europe.

“Historical past has confirmed, as soon as aluminum smelters go away, they don’t come again,” mentioned Mark Hansen, chief govt of metals buying and selling home Harmony Assets Ltd. “There’s an argument which extends past employment: this is a crucial base steel commodity, it goes into plane, weapons, transport and equipment.”

The trade says it urgently wants authorities assist to outlive. Nevertheless, any measures like fastened value caps to maintain power-hungry vegetation working could also be tough to justify whereas customers face hovering energy payments and the specter of rationing and blackouts looms.

Learn: Europe Appears Set for Vitality Rationing after Russian Reduce

The woes of the aluminum sector provide a hanging instance of what is enjoying out in Europe’s energy-intensive industries: throughout the continent, fertilizer makers, cement vegetation, metal mills and zinc smelters are additionally shutting down moderately than pay eye-watering costs for gasoline and electrical energy.

Most worryingly for the area’s manufacturing sector: it might not merely be a case of shutting for the winter. Energy costs for 2024 and 2025 have additionally soared, threatening the long-term viability of many industries.

At latest market costs, the annual energy invoice for the Slovalco smelter could be round two billion euros, in keeping with Chief Govt Officer Milan Vesely. Slovalco determined to mothball the plant resulting from a mixture of surging vitality costs and a scarcity of emissions compensation that’s out there to smelters elsewhere within the bloc.

Restarting the plant — which may take as much as a 12 months — will solely be attainable by means of some mixture of cheaper energy, a pointy rise in aluminum costs, and extra authorities assist, Vesely mentioned in an interview this week on the web site.

“It is a real existential disaster,” mentioned Paul Voss, director-general of European Aluminium, which represents the area’s greatest producers and processors. “We actually must type one thing fairly shortly, in any other case there can be nothing left to repair.”

Mixed with import tariffs that Europe’s struggling producers have fought onerous to place in place, the rising price of vitality may go away producers dealing with an more and more giant premium over prevailing worldwide costs as a way to safe provide, in an extra blow to Europe’s aggressive standing within the world industrial economic system.

“There can be nothing left to repair”

Producers of different metals like zinc and copper are hurting badly too, however the huge quantities of energy wanted to make aluminum have made the sector notably unprofitable.

In Germany, the facility wanted to provide a ton of aluminum would have price roughly $4,200 within the spot market on Friday after topping greater than $10,000 final month, in keeping with Bloomberg calculations. The London Metallic Alternate futures value was round $2,300 a ton on Friday. Meaning curtailments look set to speed up over the winter.

“Every time we get downturns in financial development and smelter margins come beneath stress, we see European smelters shutting a good portion of capability,” mentioned Uday Patel, senior analysis supervisor at Wooden Mackenzie. “When issues enhance, there are some smelters that by no means come again on-line.”

Wooden Mackenzie estimates that Europe has already misplaced about 1 million tons of its annual aluminum manufacturing capability, and Patel mentioned he expects that about 25% of that could be curtailed completely. One other 500,000 tons is “extremely weak” to closure, Wooden Mackenzie estimates.

The curtailments have had little influence on aluminum costs, which have fallen by greater than 40% since a peak in March as merchants brace for a worldwide hunch in demand that might be much more extreme.

However whereas Europe’s manufacturing losses account for about 1.5% of world provide, they may go away customers in Europe more and more reliant on imports that can be costlier and carry a heavier carbon footprint.

Already, European producers are paying hefty supply charges to get aluminum shipped to native ports, and additional will increase may go away them in an more and more uncompetitive place relative to friends throughout Asia and the US.

The vitality disaster can also be rippling shortly down the availability chain to firms that purchase aluminum from smelters and rework it into specialist merchandise utilized in all the pieces from vehicles to meals packaging.

They use important quantities of gasoline within the course of, and lots of need to cross on their surging vitality prices by way of contractual surcharges that might bake in further prices for producers for years to come back.

“The smelter curtailments are solely the tip of the iceberg, since you even have downstream gamers who’re shopping for prime steel and reworking it into merchandise to be used in sectors like beverage cans and automotives,” mentioned Michel Van Hoey, a senior associate at McKinsey & Co. These firms have usually seen a ten-fold improve of their vitality payments and “won’t be able to completely cross on these prices with out some extent of demand destruction or import substitution.”

At Slovalco, Vesely — who has labored on the firm since 1989 — is hopeful it will likely be in a position to reopen the plant as soon as vitality costs fall, however acknowledges the chance that it may stay offline for years.

“One thing have to be finished if we don’t wish to destroy European aluminum manufacturing,” he mentioned. “If Europe considers aluminum as a strategic steel, then aluminum vegetation ought to have assured costs of electrical energy.”

Extra tales like this can be found on bloomberg.com

©2022 Bloomberg L.P.

[ad_2]