[ad_1]

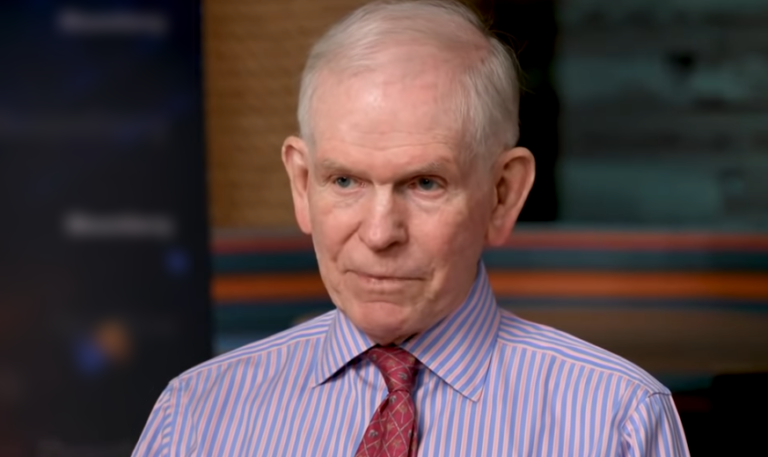

Jeremy Grantham is one of those investors who has achieved legendary status in his own lifetime. He’s made a fortune, and a reputation, as a contrarian – an investor who takes a bearish look at the market, and has a knack for calling, and avoiding, asset bubbles. And right now, Grantham points out that the stock markets are showing all the signs of a bubble on the edge of bursting, and he’s predicting a 70% chance that the market will crash in the near-term.

In brief, Grantham believes current market conditions are paralleling some famous stock bubbles, particularly those of 1929 and 2000 – and we know how those turned out. Grantham does see the excitement around AI stocks as a possible mitigating factor – but he is not optimistic. In his words, “My guess is it’s not operating on the timeframe of this bubble. We have a year or two here to have a fairly traditional bubble losing air, a fairly traditional recession, and fairly traditional decline in profit margins — and some grief in the stock market. And we can do that before the real effects of AI kick in.”

Taking Grantham’s warning at face value, we can start taking action to protect our portfolios. The simplest step would be a move into dividend stocks, the classic defensive play. Dividend stocks offer the advantage of a steady passive income stream to maintain returns in a down market. We’ve used the TipRanks database to pull up the latest info on two of these stocks, both with ‘Strong Buy’ ratings and inflation-beating dividend yields.

Enterprise Products Partners (EPD)

We’ll start with Enterprise Products Partners, a dominant force in North America’s energy landscape. Boasting a market cap of $57 billion, Enterprise stands tall as one of the largest publicly traded partnership companies in North America. Its unwavering presence extends across the entire continent, as it plays a pivotal role in the crucial realm of energy. As a formidable midstream operator, Enterprise owns and operates an extensive network of hydrocarbon transport and storage assets.

A look at some of the company’s numbers will tell the story. EPD has more than 50,000 pipeline miles for oil and natural gas in its network, along with 25 fractionation facilities and 20 deepwater docks. These transport assets are backed up by more than 260 MMBbls in liquids storage capacity. Enterprise’s operations are centered around the Gulf Coast of Texas and Louisiana, but extend into the Southwest, the Appalachians, the Mississippi Valley and Great Lakes states, and through the Plains to the Rocky Mountains.

These numbers have led to solid earnings in the first quarter of this year. While the company’s top line revenue figure, of $12.44 billion, was down 4.3% year-over-year and missed the forecast by $1.31 billion, the bottom line told a different story. The GAAP earnings, of 63 cents per share, were up 6.7% y/y and came in 1 cent ahead of expectations. By non-GAAP measures, the company’s EPS was reported at 64 cents, or 2 cents better than had been anticipated.

Along with the earnings beats, Enterprise showed a strong ability to generate cash. The company’s adjusted cash flow from operations, CFFO, was $2.02 billion for the first quarter, for a 3.5% y/y increase. The non-GAAP free cash flow (FCF) measure marked an even stronger y/y gain, turning around from a $1.62 billion deficit to Q1’s positive $1.35 billion.

The cash flows should interest dividend investors, as they provide direct support for the quarterly dividend payments. Enterprise has kept up its regular quarterly dividend going back to 1998; the last payment was declared in April with respect to 1Q23. That dividend, of 49 cents per common share, annualizes to $1.96 per share and gives a yield of 7.4%. It was paid out in May of this year.

For Stifel analyst Selman Akyol, all of this adds up to a stock that deserves a second look. Akyol particularly notes the company’s ability to fund itself from cash and to maintain the dividend, writing in a recent note, “Enterprise continues to employ a conservative and sound capital allocation plan and will achieve dividend aristocrat status this year. EPD expects to fully fund capital expenditures out of operating cash flows and recently lowered its long term leverage target to 3.0x. We expect the macro environment to be a positive for EPD especially concerning exports as the US is likely to send more crude, LNG and NGL oversees. Given an attractive setup for the partnership and strong distribution security we are maintaining our Buy rating.”

That Buy rating comes along with a $35 price target that indicates room for 33% share appreciation in the coming months. Based on the current dividend yield and the expected price appreciation, the stock has ~40% potential total return profile. (To watch Akyol’s track record, click here)

It’s clear that Wall Street is bullish on this stock – its 7 recent reviews break down 6 to 1 favoring the Buys over Holds, supporting a Strong Buy analyst consensus rating. EPD shares are priced at $26.23 and their average price target, $32.86, implies a 25% upside on the one-year time frame. (See EPD stock forecast)

Plains All American Pipeline (PAA)

Let’s stick with midstream companies, since the energy sector has always been a fruitful place to look for high dividends. Plains All American is another partnership company, and another major player in the North American midstream sector. Plains boasts a network of pipelines, transport and transfer hubs, as well as some 2,000 trucks and trailers and 6,000 railcars for moving crude oil and natural gas liquids. On the storage side, the company’s assets include 140 million barrels of capacity for crude oil and natural gas products.

Plains’ market cap stands at more than $9.9 billion, and it has the capacity to move more than 6-million-barrel equivalents of crude oil and natural gas products per day through its system. Its business involves moving hydrocarbon products from the wellheads to the refineries and export terminals, and the company has the assets to get that job done.

In addition to attending to its business of moving the product, Plains has also generated positive earnings despite a recent drop in total revenues. In 1Q23, the company reported a top line of $12.34 billion. This figure came in $2.09 billion below expectations, and was down 9.9% y/y. The bottom-line earnings figure was better, coming in at 41 cents per share by non-GAAP measures, and 5 cents ahead of the forecast.

Plains also generated $823 million in free cash flow for the first quarter, compared to $200 million in the year-ago period. The company’s free cash flow funds its dividend distribution, and even after covering the quarterly dividend payments, the FCF still came in at $581 million.

And that brings us to the dividend. Earlier this year, Plains raised its annualized common share dividend distribution payment by 20 cents, to $1.07 per share annualized. This makes the quarterly payment 26.75 cents per common share, and translates to a yield of 7.5% going forward.

The combination of strong cash flows and full dividend coverage caught the attention of Truist analyst Neal Dingmann, who notes both factors as key points for investors’ consideration.

“Plains remains well positioned to financially benefit from Permian growth given the limited capital required and ample capacity as tariff volumes continues to increase,” the 5-star analyst wrote. “We believe company expectations of 500 mbopd could be slightly conservative based on current and forecast D&C activity. We estimate the company has among the best dividend yield, FCF yield and EBITDA with ample opportunity for shareholder return give PAA also has among the lowest leverage.”

Along with his Buy rating, Dingmann also gives PAA a $17 price target to imply a one-year upside potential of ~20%. (To watch Dingmann’s track record, click here)

Overall, PAA has picked up 5 recent analyst reviews, and these include 4 Buys and 1 Hold for a Strong Buy consensus rating. The shares have an average price target of $16.40, suggesting ~18% upside from the current trading price of $13.93. (See PAA stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

[ad_2]