[ad_1]

Many investors are interested in the “Magnificent Seven” stocks for good reasons other than outstanding returns over the last year. This elite group of tech companies has strong brands and a growing customer base, and they are very profitable businesses — everything an investor looks for in a solid investment.

Over the last year, the Roundhill Magnificent Seven ETF has returned 51%, beating the Nasdaq Composite‘s 32% and the S&P 500‘s 23% return. There’s some debate about how long this group will continue to outperform in the near term. On a price-to-earnings (P/E) basis, most of these stocks trade at big premiums to the average stock in the major indexes.

The most expensive of the seven is Nvidia (NASDAQ: NVDA), which currently has a trailing P/E of 77. Despite its high valuation, the company’s superior growth and future opportunity could justify more new highs for years to come. Here’s why the stock remains a core holding in my portfolio.

Nvidia’s growth runway

Nvidia is benefiting as data centers switch from central processing units (CPUs) to the far more powerful graphics processing units (GPUs) for artificial intelligence (AI) workloads. Historically, data centers spent about $250 billion per year on infrastructure, but this amount has increased for the first time in many years, which could be just the beginning of a major spending boom.

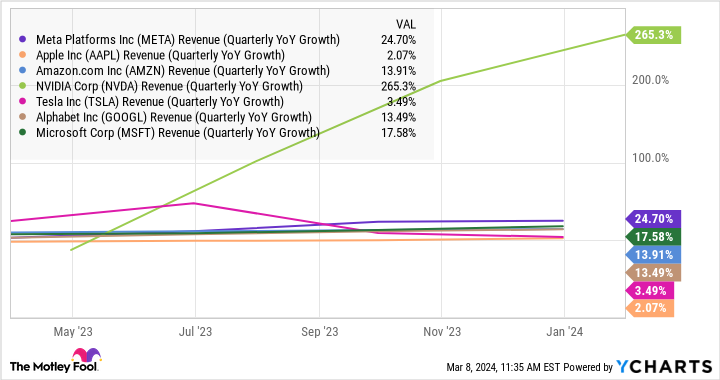

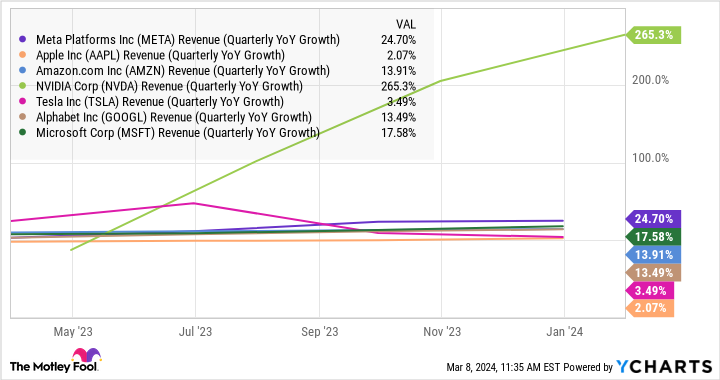

The market for Nvidia’s products is proving to be much bigger than originally thought a few years ago. Revenue surged 265% year over year to $22 billion in the fiscal fourth quarter, significantly outpacing the growth for the other Magnificent Seven companies.

Nvidia is just scratching the surface of this opportunity. Company executives have talked about $1 trillion worth of data center infrastructure that is starting to adopt accelerated computing, which is the use of multiple GPUs running together to handle large data workloads.

However, the opportunity could be much bigger. AI is allowing companies to use data in ways that was not possible before, as Nvidia chief financial officer Colette Kress discussed at the recent Morgan Stanley technology conference.

This is why there are new types of data centers emerging called GPU-specialized cloud service providers. It’s one reason Nvidia executives believe the actual data center infrastructure market could be worth closer to $2 trillion.

Why buy the stock?

AI is completely turning traditional computing on its head, which is reflected in the accelerating demand for Nvidia’s H100 GPU. It’s almost become a bragging right for companies to talk about how many H100s they have purchased. Magnificent Seven member Meta Platforms has said it plans to have 350,000 H100s up and running by the end of the year.

Demand is already outstripping supply for Nvidia’s H200 GPU, which is on track to start shipping in the fiscal second quarter. Company guidance calls for revenue to be up 234% year over year in the fiscal first quarter.

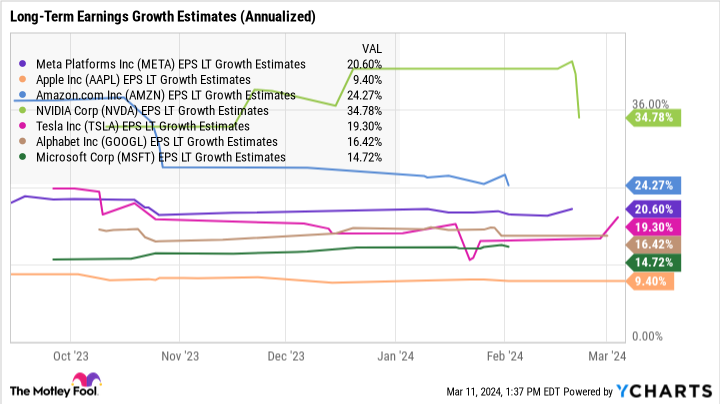

Over the long term, analysts expect Nvidia to grow earnings at 35% per year, which is also higher than the other Magnificent Seven.

Nvidia’s leading share in the GPU market should translate to more growth as data centers continue to upgrade components for AI. As this opportunity unfolds, this GPU stock offers long-term upside that could outperform the other Magnificent Seven over the next decade. Relative to expected earnings this year, Nvidia isn’t all that expensive, trading at a forward P/E of 37.

Nvidia has been the king of GPUs for many years, so it’s basically got the right product at the right time to benefit from the AI boom. But what ultimately seals the deal for me is how much cash the business is producing.

Its trailing free cash flow totaled $27 billion, up 10-fold over the last five years. This gives the company tremendous resources to stay ahead in GPU innovation and generate shareholder returns for years to come.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of March 11, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. John Ballard has positions in Nvidia and Tesla. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Here’s My Top “Magnificent Seven” Stock to Buy and Hold for the Next 10 Years was originally published by The Motley Fool

[ad_2]