[ad_1]

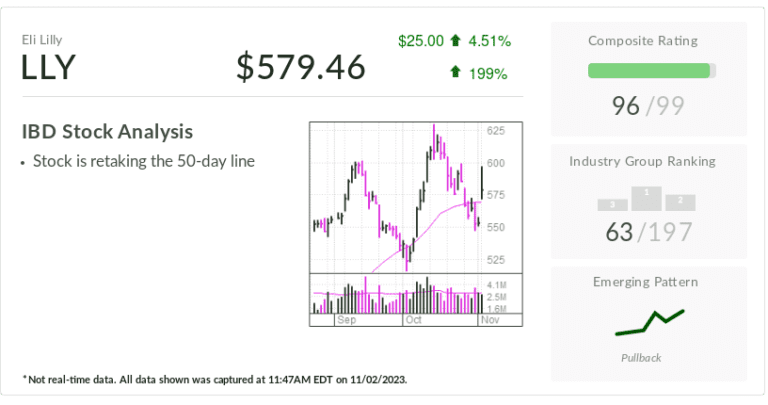

Eli Lilly

Eli Lilly

LLY

$25.00

4.51%

199%

IBD Stock Analysis

- Stock is retaking the 50-day line

![]()

Industry Group Ranking

![]()

Emerging Pattern

![]()

Pullback

* Not real-time data. All data shown was captured at

11:47AM EDT on

11/02/2023.

Eli Lilly (LLY) is Thursday’s IBD Stock Of The Day as shares surge after the drugmaker crushed Wall Street’s quarterly forecasts on the back of “explosive” growth for diabetes blockbuster Mounjaro.

X

Mounjaro is a rival of Novo Nordisk‘s (NVO) Ozempic. Lilly is hoping the Food and Drug Administration will soon sign off on Mounjaro as an obesity treatment. This would allow Mounjaro to also compete against Novo’s weight-loss behemoth, Wegovy.

In the September quarter, Mounjaro sales skyrocketed 652% to $1.41 billion. That handily beat calls for $1.28 billion, according to FactSet.

“The top-line strength was driven by the explosive growth of its type 2 diabetes drugs Mounjaro and Jardiance, as well as stellar performance by its breast cancer drug Verzenio,” Third Bridge analyst Lee Brown said in a report.

On today’s stock market, Eli Lilly stock jumped 4.7%, closing at 580.29. Shares have a strong IBD Relative Strength Rating of 97 on a 1-99 scale of a stock’s 12-month performance.

Eli Lilly Stock: Unexpected Profit

Overall, Lilly came in with adjusted earnings of 10 cents per share on $9.5 billion in sales. Earnings tumbled 95% year over year due to expected tax charges. But they also beat expectations for an 18-cent loss. Sales jumped 36% and easily topped projections for $8.97 billion.

In addition to strong Mounjaro sales, Verzenio sales advanced 68% to $1.04 billion, topping forecasts for $1 billion. Lilly also benefited from the $1.42 billion sale of its rights to Zyprexa, an antipsychotic drug. Overall Zyprexa sales came in at $1.48 billion, topping Leerink Partners analyst David Risinger’s estimate for $900 million.

But the rest of Lilly’s products largely came in below expectations, Third Bridge’s Brown said.

“Unfortunately, the majority of Lilly’s products failed to meet Street expectations as U.S. pricing, excluding favorable dynamics tied to Mounjaro, declined in the high single digits,” he said.

Fellow diabetes drug Jardiance brought in $700.8 million in sales, representing 22% growth. But that missed calls for $743 million to $765.2 million, according to Risinger and FactSet. Eli Lilly stock analysts are closely watching Jardiance’s performance after the drug gained approval to treat patients with chronic kidney disease.

Earnings Guidance Axed

Eli Lilly retained its sales outlook for $33.4 billion to $33.9 billion but cut its adjusted earnings guidance to $6.50 to $6.70 per share. At the midpoint, that’s $3.20 lower than the guidance Lilly issued three months ago. The company cited unfavorable tax charges in the third quarter.

Eli Lilly stock analysts projected adjusted earnings of $9.76 per share and $33.5 billion in sales.

Less promisingly, Lilly now expects the FDA to make a decision on approving its potential Alzheimer’s treatment in the first quarter of 2024, vs. prior expectations for this quarter.

Follow Allison Gatlin on X, the platform formerly known as Twitter, at @IBD_AGatlin.

YOU MAY ALSO LIKE:

GSK Dives As Shingrix Comes In Light Despite Strong RSV Vaccine Launch

Crispr Therapeutics Rallies On Bullish Views Of First-Ever Gene-Editing Drug

See Stocks On The List Of Leaders Near A Buy Point

IBD Stock Of The Day: See How To Find, Track And Buy The Best Stocks

[ad_2]