[ad_1]

This post was originally published on TKer.co

Stocks inched lower, with the S&P 500 declining 0.3% last week. The index is now up 6.2% year to date, up 14% from its October 12 closing low of 3,577.03, and down 15% from its January 3, 2022 closing high of 4,796.56.

“The bear market is over, but it is not the great reflation,“ Chris Harvey, head of equity strategy at Wells Fargo Securities, wrote on Monday. “We see neither a bull nor a bear market, just a market.“

Calling it a “‘just-a-market’ market,” Harvey said he expected “some giveback, but not a sharp near-term reversal.”

Indeed, we are hearing less from those who had previously forecast a big sell-off in the stock market in the early part of the year.

And while Harvey’s characterization of the stock market is a bit ambiguous, it isn’t paradoxical in the way many are viewing the economy.

An economy so good it’s bad 🙃

In last Sunday’s TKer, I discussed how bearish attitudes toward the economy were shifting bullish in the wake of strong economic data, noting that “it could take a few more weeks of resilient economic data before more economists officially revise their forecasts to the upside.“

Upgrade to paid

Well, those revisions are already coming in. Following Wednesday’s strong retail sales report, JPMorgan, Bank of America, and Deutsche Bank were among firms joining Goldman Sachs in revising up their near-term GDP forecasts or putting off their expectations for a recession.

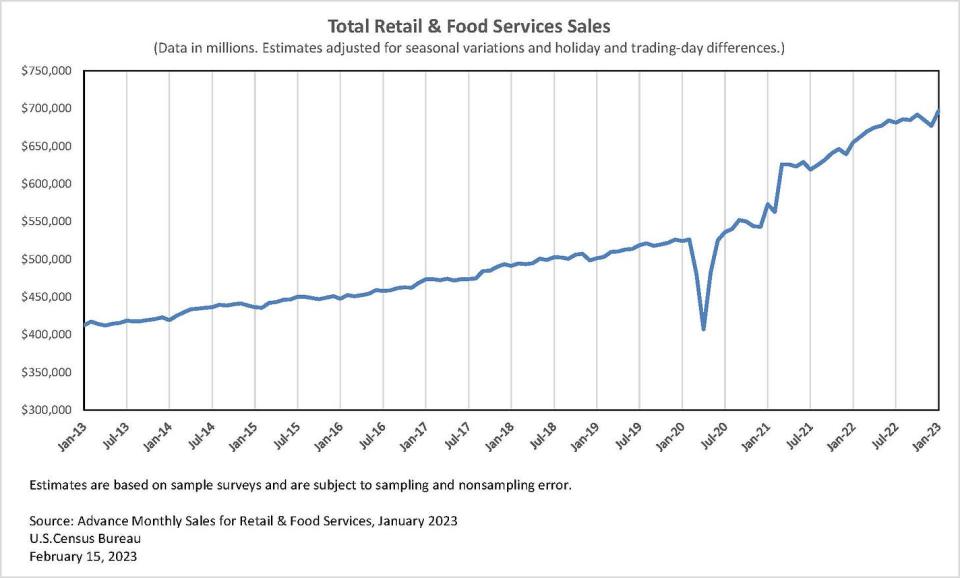

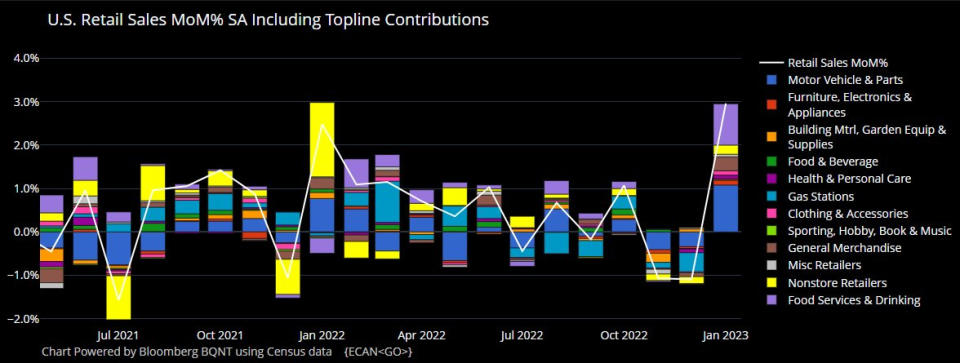

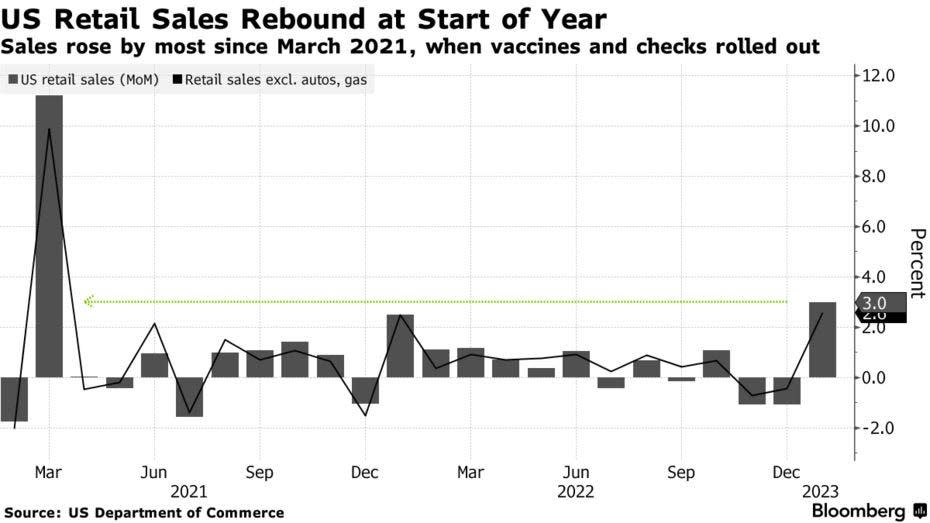

According to Census Bureau data, retail sales in January jumped 3.0% to a record $697 billion. This was the largest gain since March 2021, and it was much stronger than the 2.0% increase economists expected.

Excluding autos and gasoline, sales climbed an impressive 2.6% with gains in all retail categories.

The results were in line with Bank of America credit and debit card data released earlier this month showing an acceleration in spending.

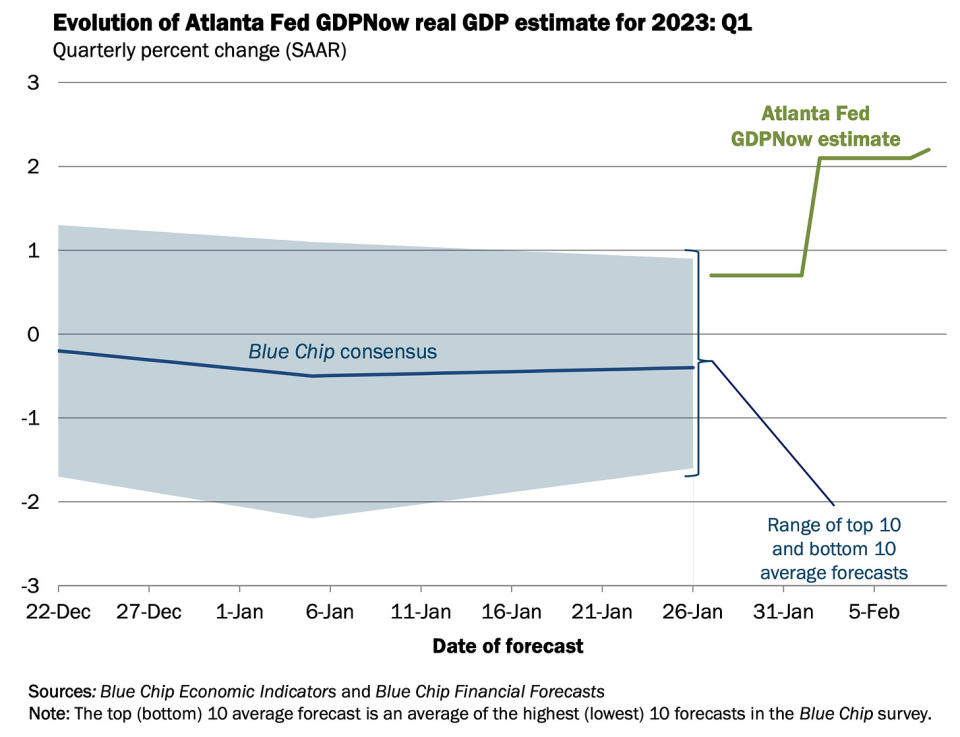

After the retail sales report came out, the Atlanta Fed’s GDPNow model saw real GDP growth climbing at a 2.4% rate in Q1. This is up from 2.2% last week, and up considerably from its initial estimate of 0.7% growth as of January 27.

And it’s not just the hard data that’s looking rosier. The soft data seems to be reflecting a less pessimistic tone as well.

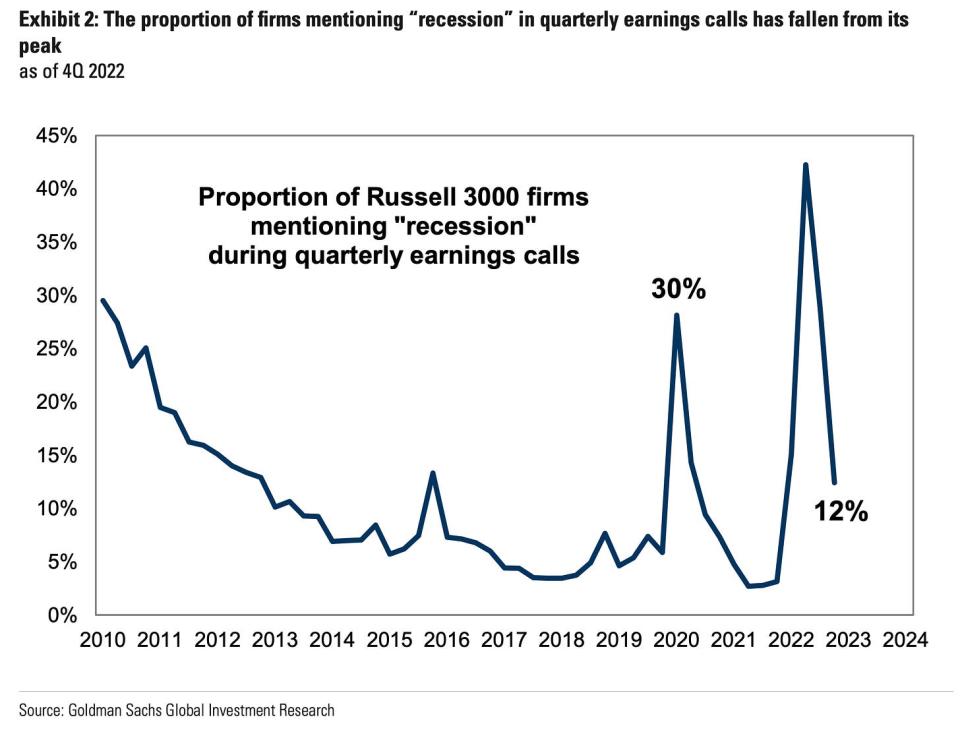

According to Goldman Sachs research published Tuesday, mentions of “recession” on quarterly earnings calls have fallen sharply.

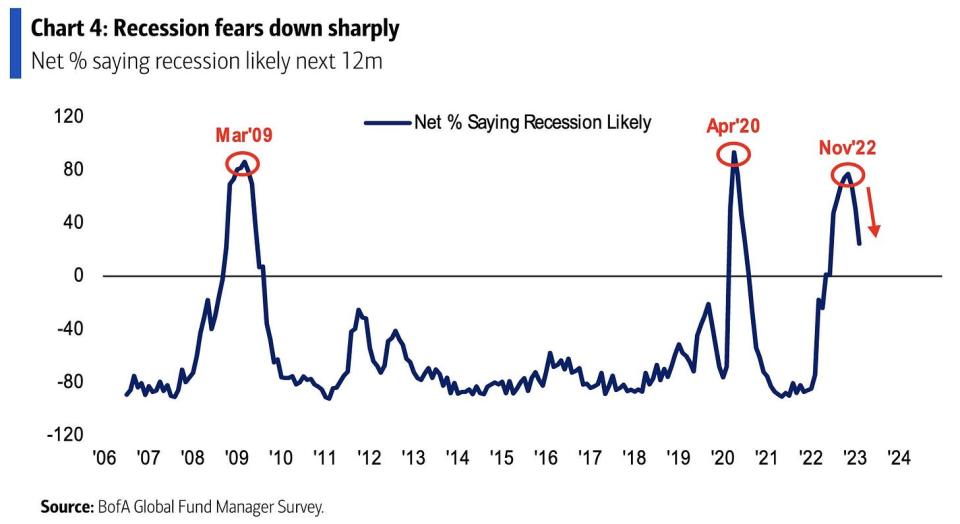

According to Bank of America’s Global Fund Manager Survey published Wednesday, “Recession odds peaked in Nov’22 at 77% and have since declined to 24% this month (down 27ppt MoM), lowest since Jun’22.“

Indeed, attitudes about economic growth have shifted to the upside.

To be fair, it’s difficult to quantify precisely what the economy will do in the very near future. But the confluence of data — including strong consumer finances and robust demand for workers — has been suggesting there was bias to the upside. For more, read: 9 reasons to be optimistic about the economy and markets 💪

Unfortunately, many economists aren’t exactly thrilled as it puts at risk ongoing efforts to bring inflation.

Here’s the problem with all of this 🤦🏻♂️

The notion that good news about the economy is bad news for inflation has been renewed in the wake of very strong data on the labor market and consumer spending.

“My new take is good news is good news, great news is bad news,” Conor Sen, a columnist for Bloomberg Opinion, tweeted last week.

Accompanying many economists’ upward revisions to their economic growth forecasts were hawkish revisions to their expectations for the path of monetary policy: Deutsche Bank, UBS, Bank of America, and Goldman Sachs were among firms warning that the Fed would hike interest rates by more than previously anticipated as it extends its fight to bring down inflation.

And hawkish monetary policy represents headwinds for both the economy and the financial markets.

Upgrade to paid

What to watch 👀

The big question is to what degree the strength in the economy interrupts the current downward trend in inflation. In other words, will we learn that the Fed’s claim that the disinflationary process started was premature?

It doesn’t help that last week’s consumer price and producer price reports were a bit hotter than some expected.

But one month’s data never confirms nor denies a trend. We may still be on track to achieve the goldilocks scenario where inflation comes down without the economy having to go into recession.

We’ll have to wait and see.

That’s interesting! 💡

From a new NBER paper titled “Algorithmic Writing Assistance on Jobseekers’ Resumes Increases Hires“:

There is a strong association between the quality of the writing in a resume for new labor market entrants and whether those entrants are ultimately hired. We show that this relationship is, at least partially, causal: a field experiment in an online labor market was conducted with nearly half a million jobseekers in which a treated group received algorithmic writing assistance. Treated jobseekers experienced an 8% increase in the probability of getting hired. Contrary to concerns that the assistance is taking away a valuable signal, we find no evidence that employers were less satisfied…

Reviewing the macro crosscurrents 🔀

There were a few notable data points from last week to consider:

🛍️ Consumers are spending. According to Census Bureau data Wednesday, retail sales in January jumped 3.0% to a record $697 billion. For more on retail sales, see above.

🏭 Industrial activity cools for a not-so-terrible reason. Industrial production activity growth was flat in December. Manufacturing output actually rose 1.0%. The main source of weakness came from something not everyone will complain about. From the Federal Reserve: “The output of utilities fell 9.9% in January, as a swing from unseasonably cool weather in December to unseasonably warm weather in January depressed the demand for heating.“

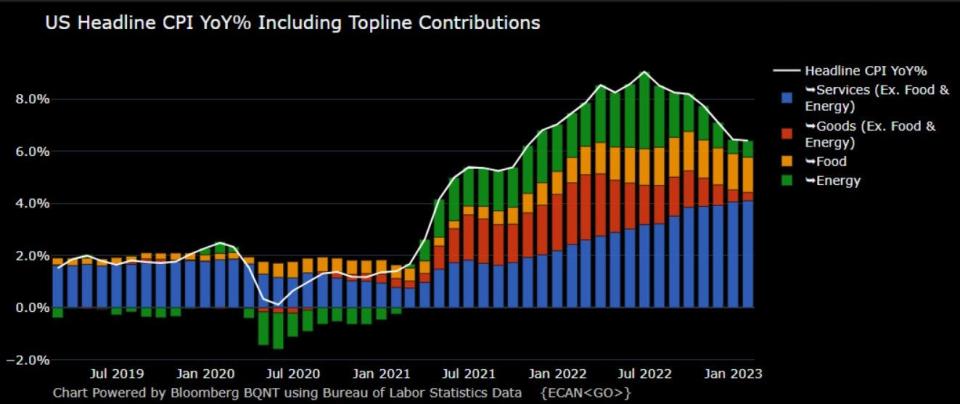

🎈 Inflation continues to cool. The consumer price index (CPI) in January was up 6.4% from a year ago, down from 6.5% in December.

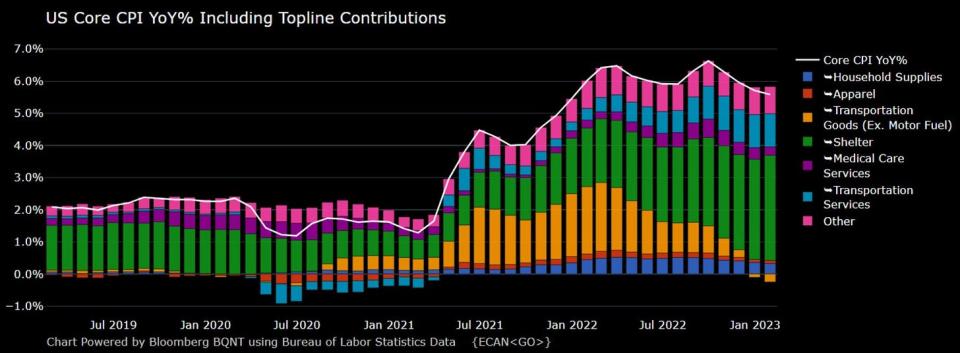

Adjusted for food and energy prices, core CPI was up 5.6% (down from 5.7%).

On a month-over-month basis, CPI was up 0.5% and core CPI was up 0.4%.

If you annualized the three-month trend in the monthly figures, CPI is rising at a 3.5% rate and core CPI is climbing at a 4.6% rate.

The bottom line is that while inflation rates have been trending lower, they continue to be above the Federal Reserve’s target rate of 2%. For more on the implications of cooling inflation, read: The bullish ‘goldilocks’ soft landing scenario that everyone wants 😀.

👍 Expectations for inflation ease. From the New York Fed’s January Survey of Consumer Expectations: “Median inflation expectations remained unchanged at the year-ahead horizon, decreased by 0.3 percentage point at the three-year-ahead horizon, and increased by 0.1 percentage point at the five-year-ahead horizon, to 5.0%, 2.7% and 2.5%, respectively.“

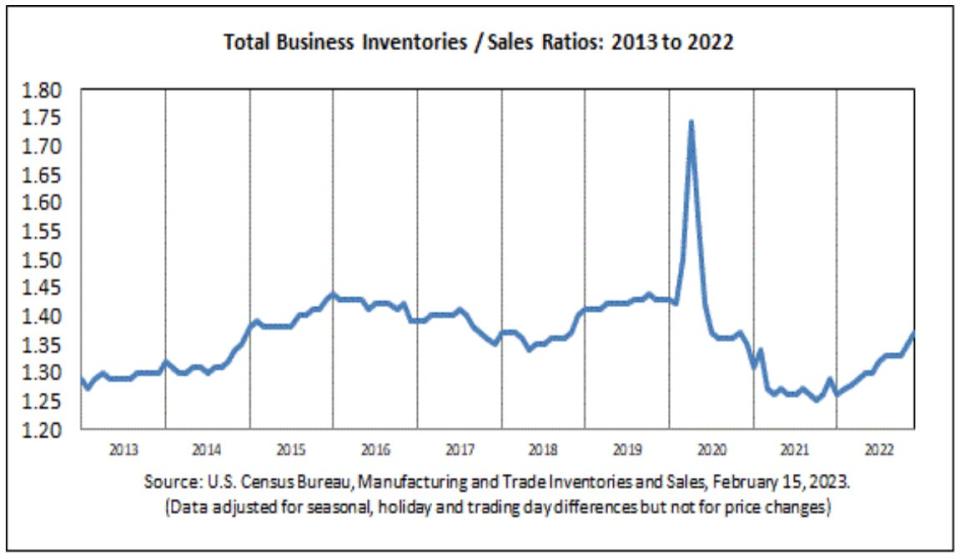

📈 Inventory levels are up. According to Census Bureau data released Wednesday, business inventories climbed 0.3% to $2.45 trillion in December. The inventories/sales ratio was 1.37, up significantly from 1.29 the previous year.

For more on supply chains and inventory levels, read: We can stop calling it a supply chain crisis ⛓, 9 reasons to be optimistic about the economy and markets 💪, and The bullish ‘goldilocks’ soft landing scenario that everyone wants 😀.

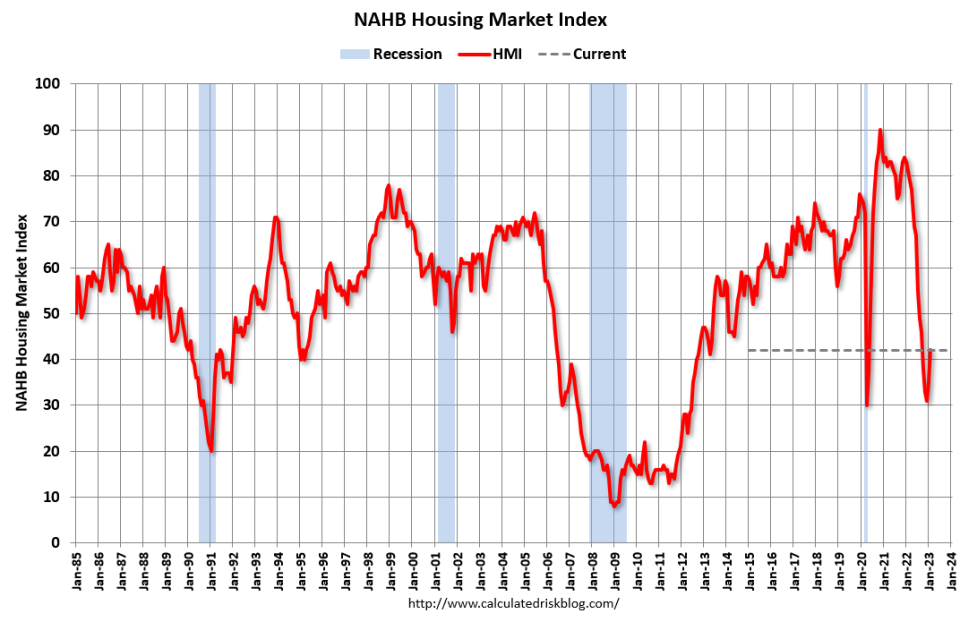

🏠 Home builder sentiment improves. According to NAHB data released Wednesday, home builder sentiment improved in February. From the NAHB chief economist Robert Dietz: “While the HMI remains below the breakeven level of 50, the increase from 31 to 42 from December to February is a positive sign for the market. Even as the Federal Reserve continues to tighten monetary policy conditions, forecasts indicate that the housing market has passed peak mortgage rates for this cycle. And while we expect ongoing volatility for mortgage rates and housing costs, the building market should be able to achieve stability in the coming months, followed by a rebound back to trend home construction levels later in 2023 and the beginning of 2024.“

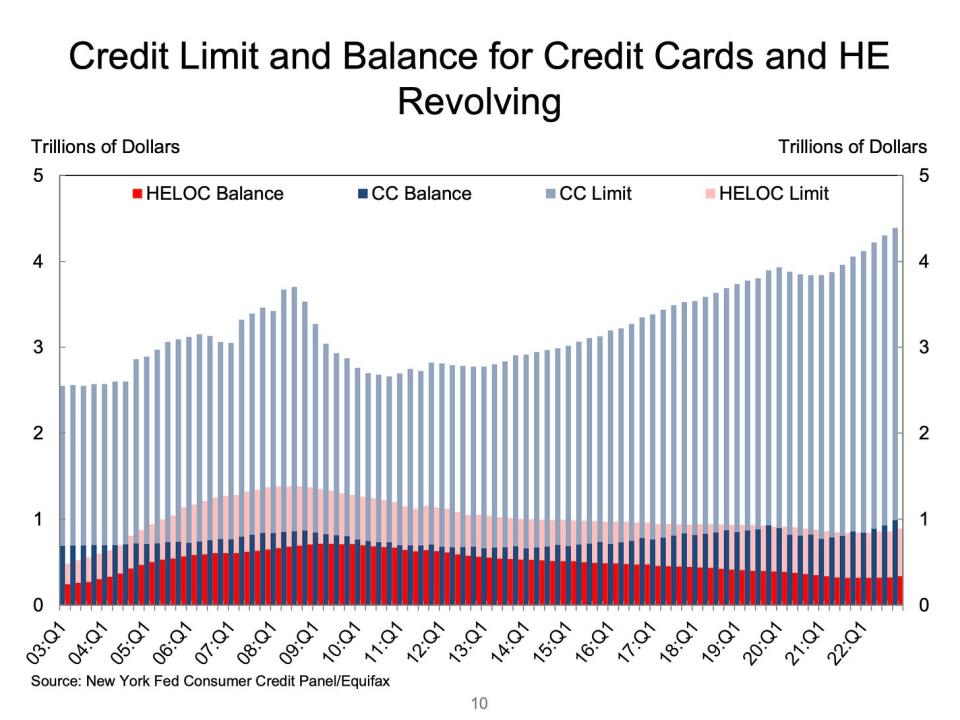

💳 Credit card balances are up. According to the NY Fed data, credit card balances increased by $61 billion to reach $986 billion during Q4, which is above the pre-pandemic high of $927 billion. With the aggregate credit limit at $4.4 trillion, however, consumers are far from maxing out their cards.

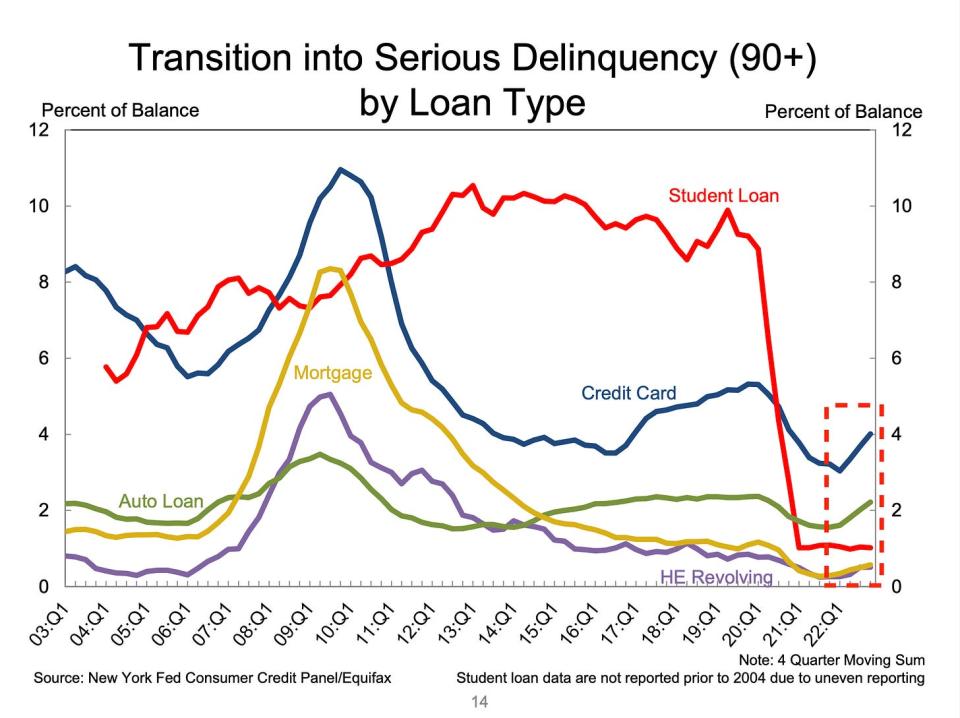

👎 Debt delinquencies continue to normalize. From the New York Fed: “The share of debt newly transitioning into delinquency increased for nearly all debt types, following two years of historically low delinquency transitions. Transition rates into early delinquency for credit cards and auto loans increased by 0.6 and 0.4 percentage points, following similarly sized increases in the second and third quarters. Delinquency transition rates for mortgages upticked by 0.15 percentage points. Those for student loans have remained flat, as the federal repayment pause remains in place.“ For more on this, read: Debt delinquency rates are normalizing 💳.

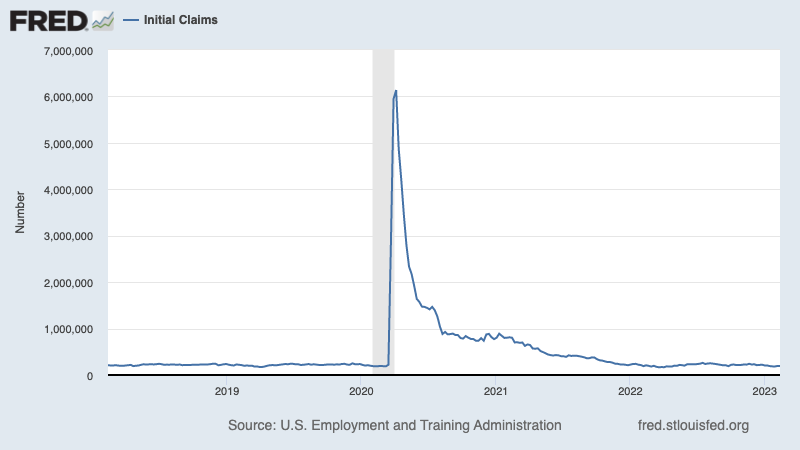

💼 Unemployment claims remain low. Initial claims for unemployment benefits fell to 194,000 during the week ending Feb. 11, down from 195,000 the week prior. While the number is up from its six-decade low of 166,000 in March 2022, it remains near levels seen during periods of economic expansion.

For more on low unemployment, read: That’s a lot of hiring 🍾, You should not be surprised by the strength of the labor market 💪, and 9 reasons to be optimistic about the economy and markets 💪.

Putting it all together 🤔

We’re getting a lot of evidence that we may get the bullish “Goldilocks” soft landing scenario where inflation cools to manageable levels without the economy having to sink into recession.

And the Federal Reserve has recently adopted a less hawkish tone, acknowledging on February 1 that “for the first time that the disinflationary process has started.“

Nevertheless, inflation still has to come down more before the Fed is comfortable with price levels. So we should expect the central bank to continue to tighten monetary policy, which means we should be prepared for tighter financial conditions (e.g. higher interest rates, tighter lending standards, and lower stock valuations). All of this means the market beatings may continue and the risk the economy sinks into a recession will relatively be elevated.

It’s important to remember that while recession risks are elevated, consumers are coming from a very strong financial position. Unemployed people are getting jobs. Those with jobs are getting raises. And many still have excess savings to tap into. Indeed, strong spending data confirms this financial resilience. So it’s too early to sound the alarm from a consumption perspective.

At this point, any downturn is unlikely to turn into economic calamity given that the financial health of consumers and businesses remains very strong.

As always, long-term investors should remember that recessions and bear markets are just part of the deal when you enter the stock market with the aim of generating long-term returns. While markets have had a terrible year, the long-run outlook for stocks remains positive.

For more on how the macro story is evolving, check out the previous TKer macro crosscurrents »

For more on why this is an unusually unfavorable environment for the stock market, read: The market beatings will continue until inflation improves 🥊 »

For a closer look at where we are and how we got here, read: The complicated mess of the markets and economy, explained 🧩 »

This post was originally published on TKer.co

Sam Ro is the founder of Tker.co. You can follow him on Twitter at @SamRo

Click here for the latest stock market news and in-depth analysis, including events that move stocks

Read the latest financial and business news from Yahoo Finance

Download the Yahoo Finance app for Apple or Android

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and YouTube

[ad_2]