[ad_1]

-

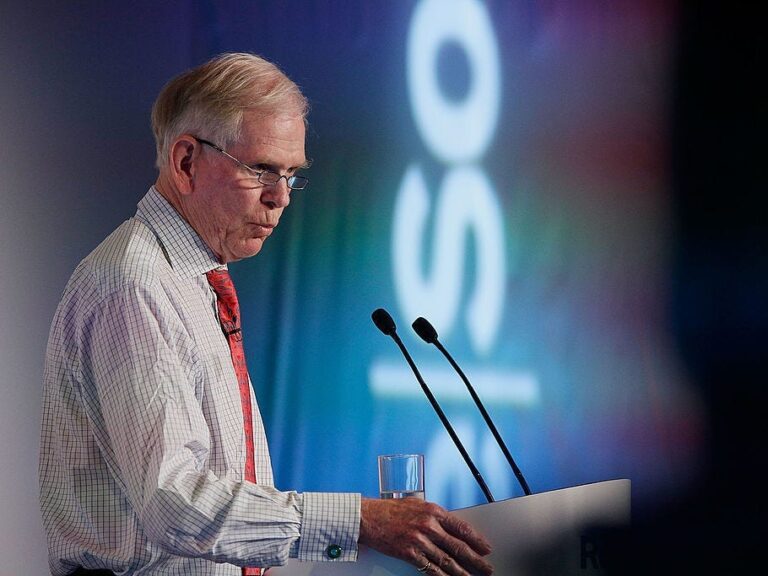

Legendary investor Jeremy Grantham warned that home prices are doomed to fall amid high mortgage rates.

-

He also called mega-cap tech stocks monopolies, opined on Tesla’s Elon Musk, and revealed what ticks him off the most.

-

These are the top 10 quotes from Grantham’s new interview with “The Compound and Friends” podcast.

Legendary investor Jeremy Grantham opined on Elon Musk’s salesmanship and said that home prices are destined to fall amid a period of elevated mortgage rates in a new interview on Friday.

Grantham joined Ritholtz Wealth Management’s Josh Brown and Michael Batnick on “The Compound and Friends” podcast and also talked about everything from the current stock market environment, asset bubbles, and what ticks him off the most.

These are the top 10 quotes from Grantham’s new interview.

1. Expect lower home prices

“Forty years of lower and lower interest rates push asset prices up, particularly housing through the mortgage mechanism. How can it not? If you can afford to pay more for your house because the mortgage rates are 3%, sooner or later you pay more for it. And so the competition bids the price up to fill the available affordability. Now the mortgage [rate] is 7%. The same thing will happen in reverse. It doesn’t happen overnight. Everyone in the market wants everything to happen yesterday. But with interest rates and mortgages, it can take a long time to percolate through. But you can be absolutely certain that it will.”

2. Real estate bubble

“Real estate is a global bubble. It has driven house prices provably to multiples of family income all over the world: Beijing, Shanghai, Sydney, Adelaide, Canada, London. It used to be multiples of three and a half times family income. London is now 10 times. Toronto is worse. No one can afford to buy a house. No young kids come out to buy a house. This is not a stable equilibrium,” Grantham said.

“House prices will come down… 30% would be a pretty good guess.”

3. The mega-cap tech stocks are monopolies

“The FAANGs are a very high average quality because, they are, let’s face it, monopolies. And they have great pricing control, obviously, and they have good profit margins. They aren’t necessarily higher quality than Coca-Cola, but combined with growth, they’re pretty damn high quality.”

4. Biggest pet peeve

“[Calling me a] bubble historian is terrific. [Calling me a] perma bear I want to shoot people.”

5. Tesla: Love the car, not the stock

“I bought a Tesla in 2019. Red. And then I wrote in a quarterly letter ‘what a terrific car.’ It was unlike anything my wife or I had ever come across. My wife hits 90 [mph] on the way to Boston most times. But I said, of course, as a stock, different story. It looks incredibly expensive. From that day, it’s up 10 times. When I wrote that it didn’t have any earnings, it didn’t look like it might have any earnings. In fact it looked quite uncertain it would exist in two years. They had a cash crunch,” Grantham said.

“If you say, ‘how did it happen,’ he [Musk] was such a wonderful propagandist that he talked the stock up way ahead of any possibility, and then he sold lots of stock. Got a lot of assets. Talked the stock up again. Sold a lot of assets over and over again until he had generated out of thin air a massive amount of real buying power which went straight into these megafactories. It was almost miraculous management generating the money out of thin air, out of bullshit and charisma.”

6. Stock market bubble

Co-host Michael Batnick asked: “Are we in a big bubble?”

“Yes, of course,” Grantham replied.

7. What the stock market loves

“It loves low inflation. It hates high inflation. It likes 2% stable inflation. It doesn’t like to see it bouncing around… Secondly, it loves high profit margins. Way down in third place is the stability of growth.”

8. QuantumScape investment

“I invested in QuantumScape nine years ago… I was so inspired by them that I wanted to make the biggest investment I’d ever made… Fast-forward a few years and it comes [public] as a SPAC, which is most unfortunate since I’ve gone on record of saying [SPACs] are so disgusting, they should be illegal, they are licenses to steal for the organizers,” Grantham said.

“QuantumScape is a brilliant research lab that finds itself in the market as a SPAC four years before having a product. So what happens? It’s a $10 [stock price], four times my investment. Two months later, it’s $131… that holding was worth $625 million. I wasn’t allowed to get out for six months… Six months later, it’s $25. We sold practically all of it, 10 times our money.”

9. The crucial ingredient to a stock market bubble

“The surge that took place in late 2020 finally had the characteristics that have been missing for 10 years. The mania came out. As I have said many times, bubbles [are] not just about price. If you get price and it’s boring, that is not a peak. You have got to see higher prices plus crazy behavior which is unique that you have never seen anything like. [NFTs], meme-stocks, QuantumScape is the biggest scale of any bubble in [stock market] history.”

10. Biggest bubble in history

“Japan real estate is the mother and father of all bubbles, much bigger than their stock market which is the mother and father of all stock bubbles. Their real estate was over 10 times downtown Manhattan. Downtown Manhattan was very high price, downtown Tokyo was over 10 times. That’s the biggest bubble I think in history, including the South Sea bubble.”

Read the original article on Business Insider

[ad_2]