[ad_1]

(Bloomberg) — Bond investors are piling into wagers that a US recession is around the corner amid a growing dissonance between how markets and the Federal Reserve see the outlook for the economy.

Most Read from Bloomberg

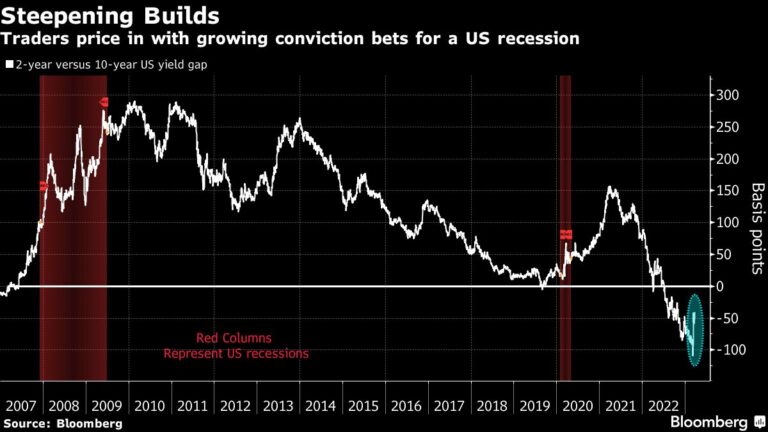

The gap is particularly evident in the yield curve — a closely watched corner of the $24 trillion market — which is headed for its steepest monthly increase since October 2008, after traders axed bets on any further interest rate hikes this year and ramped up expectations for rate cuts. That’s a striking rebuke to Fed Chair Jerome Powell who indicated this week that rate reductions in 2023 aren’t on his mind.

Many times during the past year bond markets have been wrong-footed in anticipating a policy pause and pivot to lower rates.

Now, however, there’s a groundswell of sentiment that something has broken in the wake of the first US bank failures since the 2008 financial crisis. That’s evident across markets, with a gauge of financial stocks poised for its worst month since the early days of the pandemic and Fed-dated swaps pricing a percentage-point of cuts by year-end, after betting rates could rise to peak at 5.5% earlier this month.

While Powell insisted this week lowering rates was not the Fed’s “base case” for this year, he acknowledged turmoil in the banking sector and potential for tighter lending could substitute for policy hikes. That was enough to reinforce a market view touted by the likes of Jeffrey Gundlach that the central bank will soon reverse its 12-month hiking cycle.

So even with next week’s fresh reading on the Fed’s favored core inflation measure seen staying elevated at a 4.7% annual pace, markets will remain focused on the banking crisis and threats to economic growth from the most aggressive pace of rate tightening since the Volcker era.

“Inflation is still high, but the bond market is saying we are heading into a major slowdown,” said Kenneth Taubes, chief investment officer at Amundi Asset Management US. A steeper Treasury curve after the Fed quarter-point hike “is not a typical response” and it shows a market “looking at hikes as being another nail in the economy.”

For months, the market has been fixated on curve inversion — in which rates on policy-sensitive notes climb above those on longer maturities — as a harbinger for a recession in the not-too-distant future. Now, though, the unwind of that inversion as front-end yields plummet is telling market watchers that a recession is just around the corner. Two-year yields have plunged so much they briefly slipped below 30-year rates for the first time since September, reflecting expectations that rate cuts will start coming in a matter of months.

“If the deflationary impulse that has come from the shock in the banking system is robust enough, there’s a substantially higher chance of a recession this year,” said Amar Reganti, fixed-income strategist at Hartford Funds, which manages about $124 billion. “The curve is telling you that the Fed’s hand is likely to be forced sometime this year.”

Bloomberg Economics sees a 75% chance of recession in the third quarter and projects unemployment moving to 5.0% in 2024, up from 3.6% reported in February.

Related story: New Fed Forecasts Suggest Central Bank Is Bracing for Recession

John Madziyire, portfolio manager at Vanguard, is staying with a long term — six to 12 month — steepening position in his portfolio, fading near-term rises in short-end yields and a flatter curve. “The impact of credit crunch is tighter lending conditions and a slowdown, but that is at least a quarter away,” he said.

Still, the bond market risks a nasty reversal if the Fed sticks to its stance and the economy absorbs any moderation in bank credit. Swaps indicate more than 200 basis points of cuts by the end of 2024, an outcome that would bring the Fed’s policy rate back down to around 3% from the current range of 4.75%-5%. Any wash out of those bets would inevitably bring pain.

But some argue that the true risk for traders is a hard landing, which would prompt steeper rate cuts.

“The market is pricing in quick cuts and thinks 200 basis points is enough to stabilize things,” said Priya Misra, global head of rates strategy at TD Securities. “That just takes rates to neutral, and makes sense in a soft-landing scenario,” she says, but cautions “this could become a deeper recession as you get a tightening in lending standards.”

On that score, Amundi has been adding to its exposure to Treasuries in the five to seven-year area of the curve.

“This is historically a good place to be ahead of a recession,” Taubes said. “The bond market is moving more away from the Fed” and “one way or another, I think it’s a hard landing.”

What to Watch

-

Economic data calendar

-

March 27: Dallas Fed manufacturing index

-

March 28: Wholesale inventories; advance goods trade balance; FHFA house price index; S&P core logic case-shiller home prices; conference board consumer confidence; Richmond Fed manufacturing index and business conditions; Dallas Fed services activity

-

March 29: MBA mortgage applications; pending home sales

-

March 30: Jobless claims; GDP annualized QoQ; personal consumption; GDP price index; core PCE QoQ

-

March 31: Personal income and spending; PCE deflator, MNI Chicago PMI; U. of Michiagn sentiment, inflation expectations

-

-

Federal Reserve calendar

-

March 27: Fed Governor Philip Jefferson

-

March 28: Fed Governor Michael Barr

-

March 29: Barr

-

March 30: Boston Fed President Susan Collins; Richmond Fed President Thomas Barkin

-

March 31: New York Fed President John Williams; Fed Governor Christopher Waller; Governor Lisa Cook

-

-

Auction calendar:

-

March 27: 13- and 26-week bills; two-year notes

-

March 28: Five-year notes

-

March 29: 17-week bills; two-year floating rate note; seven-year notes

-

March 30: Four- and eight-week bills

-

Most Read from Bloomberg Businessweek

©2023 Bloomberg L.P.

[ad_2]