[ad_1]

(Bloomberg) — The Federal Reserve’s preferred inflation gauges this week, along with a groundswell of consumer spending, are seen fomenting debate among central bankers on the need to adjust the pace of interest-rate increases.

Most Read from Bloomberg

The US personal consumption expenditures price index is forecast to rise 0.5% in January from a month earlier, the largest advance since mid-2022. The median estimate in a Bloomberg survey of economists expects a 0.4% advance in the core measure, which excludes food and fuel and better reflects underlying inflation.

Those monthly advances are seen slowing the deceleration in annual inflation that remains well north of the Fed’s goal. In addition, Friday’s data will underscore a fully engaged American consumer, with economists anticipating the sharpest advance in nominal spending on goods and services since October 2021.

This week’s report is also projected to show the largest increase in personal income in 1 1/2 years, fueled both by a resilient job market and a large upward cost-of-living adjustment for Social Security recipients.

In sum, the income and spending data are expected to illustrate the challenge confronting a Fed in the midst of its most aggressive policy tightening campaign in a generation. The report follows figures this past week revealing a spike in retail sales and hotter-than-anticipated consumer and producer price data.

What Bloomberg Economics Says:

“It’s stunning that the decline in year-over-year inflation has stalled completely, given the favorable base effects and supply environment. That means it won’t take much for new inflation peaks to arise.”

—Anna Wong, Eliza Winger and Stuart Paul. For full analysis, click here

Investors have been upping their bets on how far the Fed will raise rates this tightening cycle. They now see the federal funds rate climbing to 5.3% in July, according to interest-rate futures. That compares with a perceived peak rate of 4.9% just two weeks ago.

Minutes from the Fed’s latest policy meeting, at which the central bank raised its benchmark rate by 25 basis points, will also be released on Wednesday. The readout may help shed light on the appetite for a bigger increase when policymakers convene again in March after recent comments from some officials suggested as much.

Cleveland Fed President Loretta Mester said this week that she had seen a “compelling economic case” for rolling out another 50 basis-point hike earlier this month, while the St. Louis Fed’s James Bullard said he wouldn’t rule out supporting such an increase in March.

January new- and existing-home sales, along with the second estimate of fourth-quarter gross domestic product, are among other US data releases this week.

Elsewhere, in North America, Canada’s January inflation data will inform trader bets on the future path of rates after the Bank of Canada declared a conditional pause to hikes, only to see the labor market tighten further.

Meanwhile testimony by Japan’s next central-bank chief, a Group of 20 meeting of finance ministers, and rate increases in New Zealand and Israel, are among other highlights of the week ahead.

Click here for what happened last week and below is our wrap of what is coming up in the global economy.

Asia

In a big week for central banking in Asia-Pacific, investors will get their first detailed look into Kazuo Ueda’s policy views on Friday during the first parliamentary hearings for the nominee to become Bank of Japan governor.

That’ll follow another expected rate hike from the Reserve Bank of New Zealand as it continues to battle inflation in excess of 7%.

The Bank of Korea is predicted to pause amid signs of strain in its economy, though another hike can’t be ruled out given inflation remains above 5%.

Minutes from the most recent Reserve Bank of Australia meeting are likely to give more insight into the board’s thinking on further rate hikes as Governor Philip Lowe battles to fight off criticism over his leadership.

Ahead of the weekend, Japanese inflation figures are expected to show there’s still plenty of heat in prices for the new BOJ governor to consider.

And in India, Group of 20 finance chiefs will meet later in the week to discuss the world economy in their first such gathering of the year.

Europe, Middle East, Africa

Euro-region data highlights include the flash survey readings from purchasing managers for February, providing insights into how well the economy is holding up after unexpectedly growing in the fourth quarter. That’s scheduled for Tuesday.

The final reading of euro-zone inflation, due on Thursday, will take on greater significance than usual after delayed German data was omitted from the first estimate. Economists anticipate a small upward revision.

In Germany itself, the Ifo index of business sentiment on Wednesday will signal how Europe’s biggest economy is weathering the energy crisis. Economists forecast improvements on all key measures.

In the UK, where inflation slowed more than expected last month, investors will watch for analysis of what that means for policy from Bank of England officials. Catherine Mann and Silvana Tenreyro are both scheduled to make appearances.

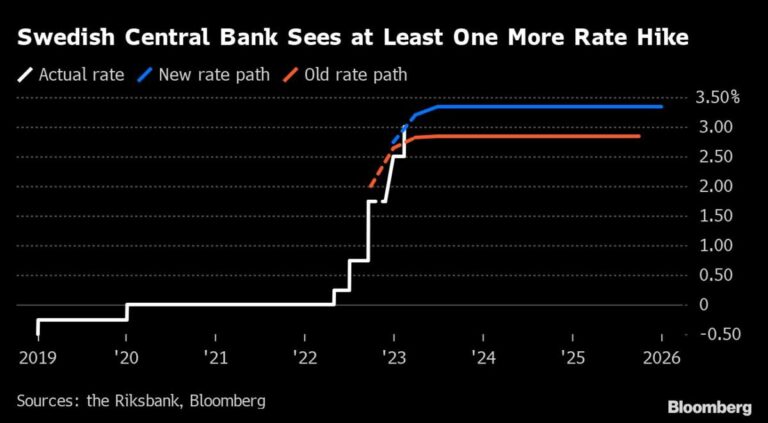

Over in the Nordic region, on Monday the Riksbank will release minutes of its inaugural meeting of 2023. That decision, which featured a half-point rate increase, a pledge to sell bonds, and a pivot toward seeking a stronger krona, was the first for new Swedish Governor Erik Thedeen.

Looking south, Israel’s central bank will likely deliver the smallest rate hike of its monetary tightening cycle by lifting its benchmark a quarter percentage point to 4% on Monday. But a surprise pickup in inflation, alongside political turbulence, raise the risk that policymakers could opt for a more aggressive move.

South African Finance Minister Enoch Godongwana will present his annual budget on Wednesday. He’s expected to announce how much of state power utility Eskom Holdings SOC Ltd.’s 400 billion-rand ($22 billion) debt will be taken over by the government.

Nigerian data on Wednesday may show growth slowed to 1.9% in the fourth quarter from 2.3% in the prior three-month period, according to economist estimates. That’s as cash shortages, rising debt-servicing costs, deteriorating fiscal balances, a plunging naira and election jitters curtail spending and investment.

Turkey’s central bank is set to cut rates to less than 9%, as pledged by President Recep Tayyip Erdogan earlier this month. The country’s devastating earthquakes will also spur officials to carry out more easing on Thursday, economists say.

Latin America

In Mexico, the mid-month consumer price report should underscore the obvious: inflation is elevated, well over target and sticky as the headline rate hovers near 7.8% while core readings continue to run above 8%.

The minutes of Banxico’s Feb. 9 meeting may offer some guidance on what policymakers see as a possible terminal rate from the current 11% and how long they might decide to keep it there.

December GDP-proxy data from Argentina and Mexico will probably show that both economies are cooling rapidly. Peru’s fourth-quarter output report is also predicted to reveal a drop in momentum, capturing the December onset of political turmoil and nationwide unrest set off by President Pedro Castillo’s ouster.

Brazil’s central bank posts its market expectations survey at mid-week with the end of the Carnival holiday. Both President Luiz Inacio Lula da Silva and central bank chief Roberto Campos Neto gave high-profile interviews that may help damp tensions over monetary policy that are at least partly to blame for rising inflation expectations.

Mid-month consumer price data posted Friday may show inflation is hung up near the 5.79% currently forecast for year-end 2023 and precisely where it finished 2022.

–With assistance from Paul Jackson, Robert Jameson, Paul Richardson and Stephen Wicary.

Most Read from Bloomberg Businessweek

©2023 Bloomberg L.P.

[ad_2]