[ad_1]

Apple (NASDAQ: AAPL), Microsoft, Nvidia, Amazon, Alphabet, Meta Platforms, and Tesla are seven tech companies that have come to be known as the “Magnificent Seven.”

Although investors usually target this bunch for their growth potential, some may wonder which Magnificent Seven stock is the least expensive.

Based on a few popular valuation metrics, Apple stands out as the best all-around value of the group. Here’s why Apple is inexpensive relative to its top tech peers.

Apple’s discounted valuation

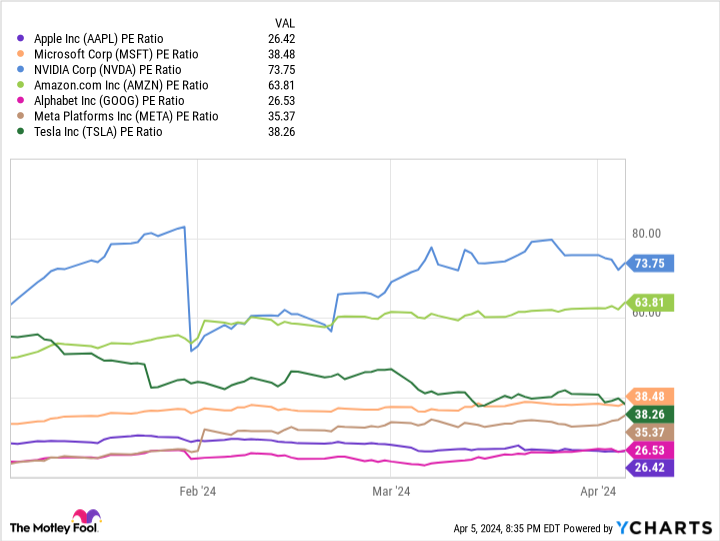

For younger, unprofitable companies, the price-to-sales (P/S) ratio can be a good metric for evaluating a stock and its value relative to its revenue. But for more mature, industry-leading companies — which includes all of the Magnificent Seven — the price-to-earnings (P/E) ratio is arguably a better metric.

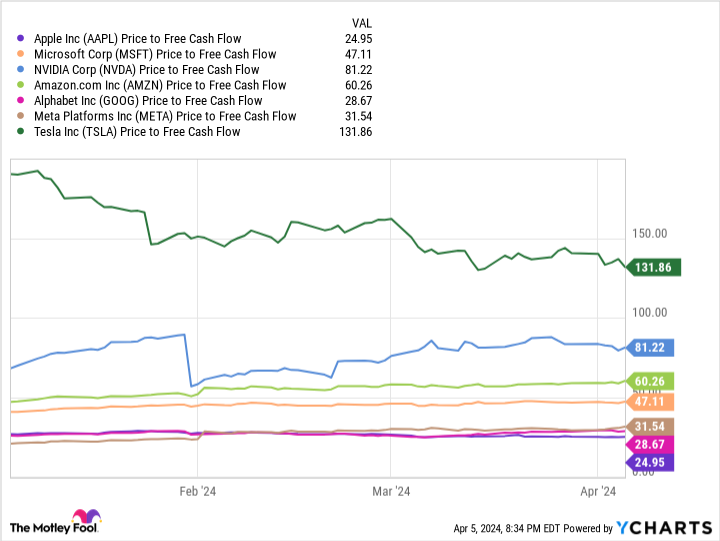

But accounting nuances can sometimes inflate or discount a company’s earnings. A one-off impairment charge or gain from the sale of assets don’t reflect core operations. With that in mind, looking at the P/E ratio in tandem with price-to-free cash flow (P/FCF) can give investors a more accurate representation of a company’s valuation.

Not long ago, Alphabet was the least expensive Magnificent Seven stock. But a 15% rally for the stock in the past month has pushed its valuation higher. Meanwhile, Apple is down 3% over the same period.

As a result, Apple now has the lowest P/E ratio of the Magnificent Seven stocks.

And it also has the lowest P/FCF multiple at 25.

Since Dec. 2023, Apple’s P/E valuation has fallen enough that it now trades at a discount to the S&P 500. But there are some good reasons for this.

Apple’s issues in a nutshell

The abridged version of Apple’s woes: Its growth has ground to a halt. The company is facing negative sales growth in China, and it hasn’t monetized artificial intelligence (AI) in a meaningful way, while the majority of the Magnificent Seven have. A core reason Microsoft overtook Apple to become the most valuable company in the world is its short- and long-term runway for leveraging AI across its business segments.

Apple’s lack of iPhone innovation has been a concern for years. But maybe more alarming is the dry spell in its new product development pipeline. The Apple Vision Pro is the latest product, but it remains to be seen if that will pay off in the same way as past products like the iPad, Apple Watch, AirPods, and others. Besides the Vision Pro, Apple hasn’t released a showstopper product since the AirPods in Sept. 2016.

This is still a massively profitable company that can buy back a boatload of its own stock while raising its dividend, which can help make the valuation more attractive even when growth is slow. But what Apple really needs is innovation.

Restoring investor confidence

On Mar. 26, Apple announced its annual Worldwide Developers Conference will take place at Apple Park in Cupertino, California, from June 10 to June 14. To quote the announcement:

Free for all developers, WWDC24 will spotlight the latest iOS, iPadOS, macOS, watchOS, tvOS, and visionOS advancements. As part of Apple’s ongoing commitment to helping developers elevate their apps and games, the event will also provide them with unique access to Apple experts, as well as insight into new tools, frameworks, and features.

The stakes are high for two reasons. The first is that this is an opportunity for Apple to flex its technological advancements with product announcements likely to come during its annual September unveiling event. The second is the company’s relationship with developers is the spotlight of the Department of Justice’s lawsuit against Apple.

Apple is in a unique position because it needs to show progress while also conveying that it’s treating developers fairly.

Buying Apple for the right reasons

Negative sentiment has mounted against Apple, in contrast to the many tech giants now enjoying AI-fueled valuation expansions.

Despite this near-term pressure, Apple’s core investment thesis hasn’t really changed. It’s still an industry-leading company with arguably the most impressive vertical integration on the planet. An investment in Apple is about its multi-decade runway in consumer electronics, the integration and value add of services like Apple TV and Apple Music, and new product developments.

The company may face some near-term challenges, but its stock shouldn’t trade at a discount to the broad market. Investors who have been watching Apple are now getting an opportunity to buy its stock at a good value. However, they’ll need to be patient as it could take a while for Apple to regain favor.

Should you invest $1,000 in Apple right now?

Before you buy stock in Apple, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Apple wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of April 8, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Daniel Foelber has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Meet the Cheapest “Magnificent Seven” Stock According to These Key Financial Metrics was originally published by The Motley Fool

[ad_2]