[ad_1]

Many people know Michael Burry from the book The Big Short, or the movie that was based on it. Both chronicled the story of a ragtag group of investors who bet against the U.S. housing market before the 2008-2009 financial crisis, shorting mortgage-backed securities at a time when everyone else thought housing was set to go up forever. Burry is still investing today, and runs Scion Asset Management.

In 2023’s fourth quarter, Scion Asset Management reported two purchases that may surprise his value-investing followers: Amazon (NASDAQ: AMZN) and Alphabet (NASDAQ: GOOG). These “Magnificent Seven” growth stocks have typically been shunned by value investors due to their high earnings multiples. Yet as of the end of 2023, they made up 10% of Burry’s stock portfolio.

So why did Burry open positions in Amazon and Alphabet?

Amazon: Profits are finally arriving

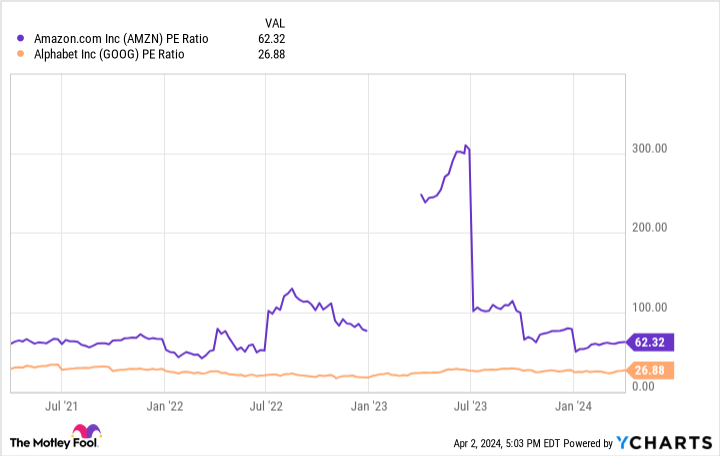

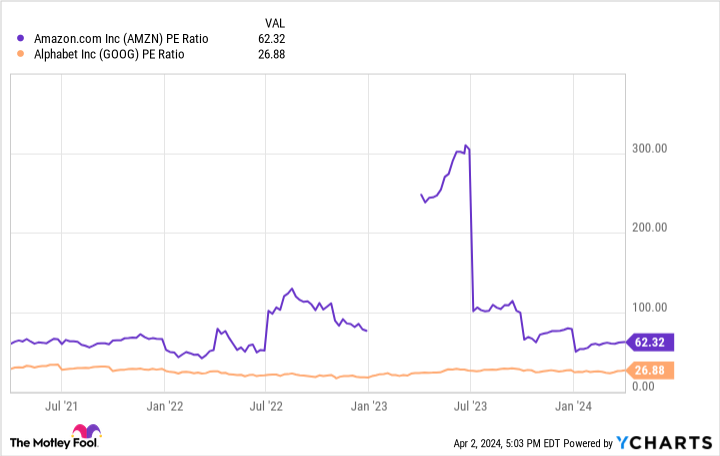

At first glance, Amazon seems overvalued. Its price-to-earnings ratio (P/E) of 62 is more than twice the average of the S&P 500 index (28, as of this writing). However, when you look under the hood, it is clear that Amazon did not show its true profit potential in 2023. Throughout last year, the e-commerce and cloud computing giant expanded its operating margin, leading to approximately 7.5% margins for the last two quarters. That was up significantly from the 2.5% margins it posted in late 2022 and early 2023.

Had Amazon been earning a 7.5% profit margin for the entire year on its total revenue of $575 billion, it would have generated $43 billion in profits in 2023. Against its current market cap of $1.9 trillion, that would have given it a P/E of 44. But even this doesn’t tell the full story. Amazon’s profit margins should continue to move higher in 2024, for multiple reasons. First, its high-margin cloud computing division, Amazon Web Services (AWS), continues to shine. Second, it is seeing strong growth from higher-margin e-commerce services such as third-party selling management and advertising. Advertising revenues, for reference, grew by 26% year over year last quarter.

If Amazon’s profit margin reaches 10% in 2024 and its revenue grows by 10% to $630 billion, it will generate $63 billion in earnings this year. That would give it a P/E of 30, or right around the S&P 500’s average. Burry likely anticipates that profit inflection happening as well, which would explain why he is buying shares for Scion Asset Management’s portfolio.

Alphabet: From AI loser to AI winner

Burry’s other Magnificent Seven bet, Alphabet, is not optically expensive, but it faced some major negative narratives throughout 2023. At the beginning of 2023, the tech giant traded at a P/E ratio below 15, likely due to investor fears that it was losing the race in AI to upstarts such as OpenAI. Today, it trades at a P/E of 27, which is still slightly below the S&P 500 average, even though the stock is up 77% year to date.

Burry and other investors likely expect Alphabet to maintain its overwhelming share of the search market, which gives it a lucrative digital advertising business. Google Search’s market share has remained remarkably steady despite all these new AI competitors, at over 90% according to the latest estimates. In the fourth quarter of 2023, Google Search revenue grew 12.7% year over year to $48 billion.

Alphabet also has promising businesses in YouTube and Google Cloud. YouTube is the dominant player in video streaming worldwide, generating $9.2 billion in advertising revenue last quarter and hitting 100 million premium subscribers. Google Cloud does right around the same in quarterly revenue and is growing sales by 25% year over year.

If Alphabet maintains its lead in Google Search and keeps growing YouTube and Google Cloud, the stock will likely do well over the long term.

Learn from investing greats, but don’t copy them

Looking through the portfolio holdings of famous investors can be insightful. But nobody should be out there blindly buying up every company in Burry’s portfolio.

First off, we outsiders can’t know what Burry’s actual theses are on these two stocks. His reasons for holding them may differ from your own, and that could create some discomfort for you if the stocks start falling. Second, the investing public only finds out about hedge funds’ moves through their 13-F filings with the Securities and Exchange Commission. These filings are due a month and a half after the end of the quarter they cover, and the most recent ones describe where their portfolios stood at the end of 2023. As such, we can have no idea if Burry has bought or sold Amazon and Alphabet shares in 2024, or if he even has any exposure to the stocks right now. This informational time lag makes trying to copy the moves of famous investors a dangerous idea.

Learn from the investing greats, but don’t copy them. It’s better to build your portfolio with stocks you believe in, not stocks you believe that others believe in.

Should you invest $1,000 in Amazon right now?

Before you buy stock in Amazon, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Amazon wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of April 4, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Brett Schafer has positions in Alphabet and Amazon. The Motley Fool has positions in and recommends Alphabet and Amazon. The Motley Fool has a disclosure policy.

“Big Short” Investor Michael Burry Has 10% of His Portfolio in 2 “Magnificent Seven” AI Stocks was originally published by The Motley Fool

[ad_2]