[ad_1]

-

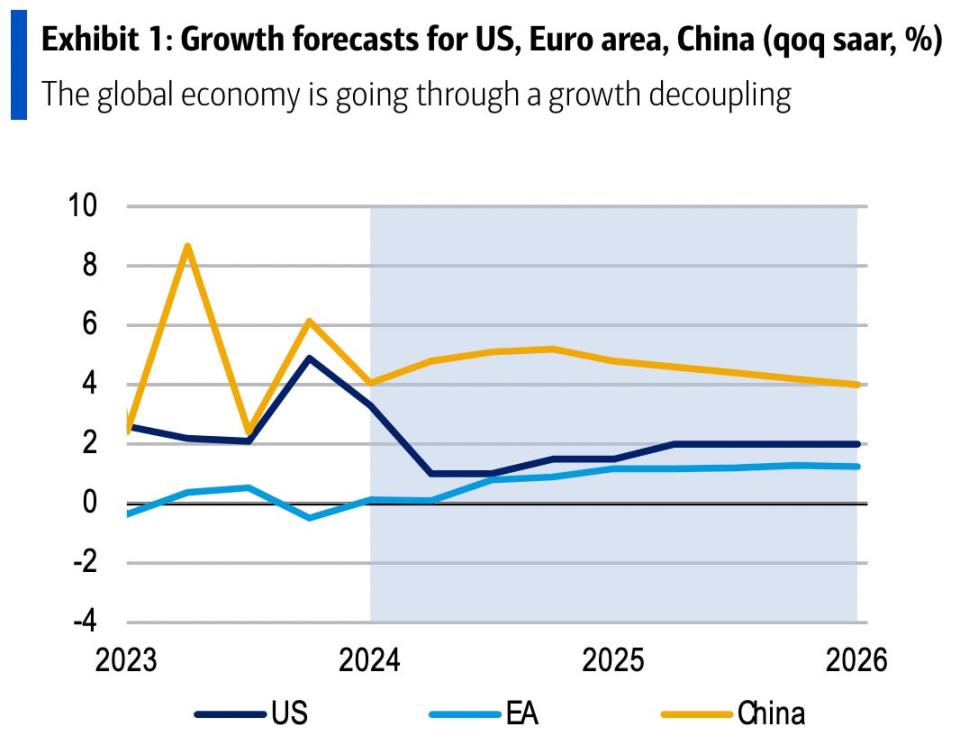

The world’s biggest economies are seeing a “decoupling,” Bank of America says.

-

The US is showing surprising resilience, European growth is weak, and China is faltering.

-

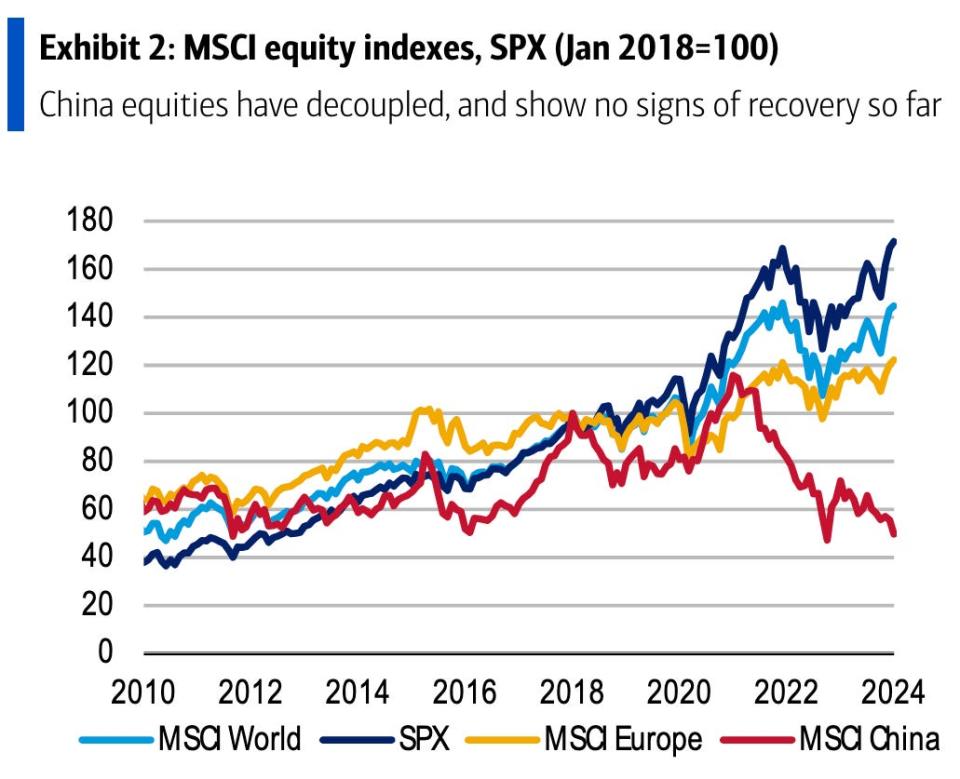

Global stocks have reflected the shifting tides in trade and supply chains.

The biggest players in the global economy are on different trajectories, and markets around the world are reflecting the shifting landscape.

In Bank of America’s view, the US economy continues to show remarkable resilience, European growth has faltered, and China faces the most challenging outlook amid real estate woes, deflation, and demographic headwinds.

“Signs of decoupling are present in global growth, trade, and equity markets,” Bank of America strategists wrote in a Friday note.

The US in particular has seen strong GDP growth in recent quarters and steadily cooling inflation, as well as promising economic data and a stock market rally that won’t quit.

Bank of America holds a soft landing and easing monetary policy beginning in June as their base case for the US. Many on Wall Street share a similar view, and investors have traded on that optimism, with the S&P 500 hitting a string of records over recent weeks.

Stronger-than-expected growth and robust labor market data to close out 2023 suggest continued positive momentum in the new year, according to BofA.

Tighter financial conditions have put the US commercial real estate sector under more pressure, the firm noted, and that’s manifested in greater pain the office-building market. Treasury Secretary Janet Yellen has voiced her concern on CRE, but remains assured that it won’t devolve into a systemic risk to the banking sector.

There’s still some uncertainty on what the Federal Reserve will do next to address the “last mile” of inflation, but that won’t dramatically sway the US’s positioning compared to other economic powerhouses.

To that point, the outlook for the Euro area looks softer.

“[G]rowth in the Euro area has been very anemic, including weaker-than-expected data in Germany,” strategists said. “In spite of this, our base case remains for the ECB to start cutting rates in June.”

BofA expects Euro area growth at 0.4% in 2024 and 1.1% in 2025. But Germany, the bloc’s biggest economy, will be weak at -0.4%, and Spain will show its strength with 1.3% growth. The wide spectrum of outlooks within Europe will eventually converge, assuming there are no additional growth shocks.

“From a market perspective, weakness in Germany is easier to digest than weakness in the periphery,” strategists maintained. “German domestic demand remains a large driver for other Euro area countries’ exports, but so do German exports themselves given the integration of the inner-Euro area production chain.”

And China, for its part, faces a unique bearish cocktail of unfavorable demographics, bleak consumer confidence, and an exodus of foreign investors.

Those contrasting economic performances have shown up in stocks, with China lagging the world and struggling to shake the “uber-bearish” narrative.

“SPX has outperformed the MSCI World Index, while European equities underperformed in comparison,” BofA strategists said. “Moreover, the decoupling of China equities is starker, and has yet to show any signs of recovery.”

Read the original article on Business Insider

[ad_2]