[ad_1]

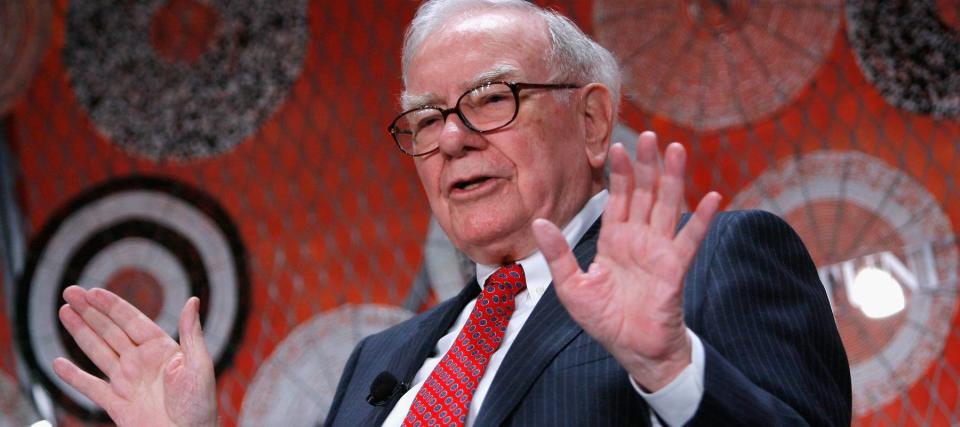

Legendary investor Warren Buffett has generated substantial returns for the shareholders of his company, Berkshire Hathaway. From 1964 to 2022, Berkshire delivered an overall gain of 3,787,464%.

Given the astonishing track record, one might assume that Buffett would want this successful trajectory to continue through his estate after his passing. However, the Oracle of Omaha has a different plan.

Don’t miss

In his 2013 letter to Berkshire shareholders, Buffett shed light on the directives he has included in his will.

“One bequest provides that cash will be delivered to a trustee for my wife’s benefit,” he wrote. “My advice to the trustee could not be more simple: Put 10% of the cash in short-term government bonds and 90% in a very low-cost S&P 500 index fund.”

Buffett recommended using Vanguard’s S&P 500 index fund.

While this strategy is straightforward and doesn’t require constant monitoring or active trading, Buffett expressed a significant amount of confidence in it.

“I believe the trust’s long-term results from this policy will be superior to those attained by most investors — whether pension funds, institutions or individuals — who employ high-fee managers,” he said.

‘The best thing to do’

An S&P 500 index fund is a type of mutual fund or exchange-traded fund (ETF) designed to replicate the performance of the S&P 500 Index, a primary benchmark for the U.S. stock market. The index reflects the stock performance of 500 of the largest companies listed on stock exchanges in the U.S. and is often considered a barometer for the overall economy.

While Buffett advocates everyday investors make use of index funds, he does not dismiss the value of his own company.

Read more: Thanks to Jeff Bezos, you can now cash in on prime real estate — without the headache of being a landlord. Here’s how

During Berkshire’s 2021 annual shareholders meeting, Buffett addressed a question about whether his directive to the trustees of his estate to invest significantly in an index fund represents a lack of confidence in Berkshire’s management.

“Well, no, because we’re talking about way less than 1% of my estate,” he clarified, noting that approximately 99.7% of his estate will either go to philanthropies or to the federal government.

“I just think that the best thing to do is buy 90% in S&P 500 index fund,” Buffett emphasized.

The average person can’t pick stocks

Buffett’s preference for recommending index funds stems from his belief that stock picking is not an optimal strategy for average investors.

At the 2021 shareholders meeting, he stated frankly, “I do not think the average person can pick stocks.”

This is where index funds come into play.

Investing in an S&P 500 index fund is not complicated: one simply purchases the fund and holds onto it without the need to select individual stocks.

It’s a passive investment strategy. The fund aims to replicate the index’s performance by holding the same stocks in the same proportions as they appear in the index. Unlike actively managed funds, where fund managers make decisions about how to allocate assets, index funds try to match the index, not outperform it.

Moreover, by investing in an S&P 500 index fund, investors get exposure to 500 large companies across various industries. This diversification can help reduce risk because the fund’s performance isn’t tied to the success or failure of a single company.

In 2023, the S&P 500 surged 24% — and it’s up nearly 6% in 2024.

What to read next

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.

[ad_2]