[ad_1]

Artificial intelligence (AI) has been the hottest topic in tech over the past year and a half. It has seemingly become unavoidable as the technology has been thrust into the mainstream, largely because of the commercial success of generative AI tools like ChatGPT.

The commercialization of AI has been a catalyst for many tech companies’ stock prices recently as well. Lots of companies even remotely dealing with AI have seen their stock prices surge as investors rushed to capitalize on the recent boom. Despite the success of many of these companies, there seems to be a lot more room for growth.

Investors looking to get exposure to the industry should consider the following three companies that are ready for a bull run.

1. Microsoft

After years of trailing behind Apple, Microsoft (NASDAQ: MSFT) has become the world’s most valuable public company, with a market cap of over $3.1 trillion.

Microsoft’s AI involvement primarily comes from its strategic partnership with ChatGPT creator OpenAI. What began as an initial $1 billion investment in OpenAI in 2019 has become deeply mutually beneficial.

OpenAI needs vast, scalable supercomputing capabilities to operate as effectively as possible. That’s where Microsoft comes into the picture. Microsoft’s cloud platform, Azure, serves as OpenAI’s main computing infrastructure, and in return, Microsoft gets exclusive licenses to OpenAI’s large language models (LLMs).

Having access to OpenAI’s LLMs has given Microsoft a leg up because it’s able to integrate them into its products and services and boost its offerings. Microsoft already has a diverse ecosystem of services that many consumers and corporations rely on. Add an AI component to make them more effective and “intelligent,” and the potential for these services to dominate their industries increases.

2. CrowdStrike

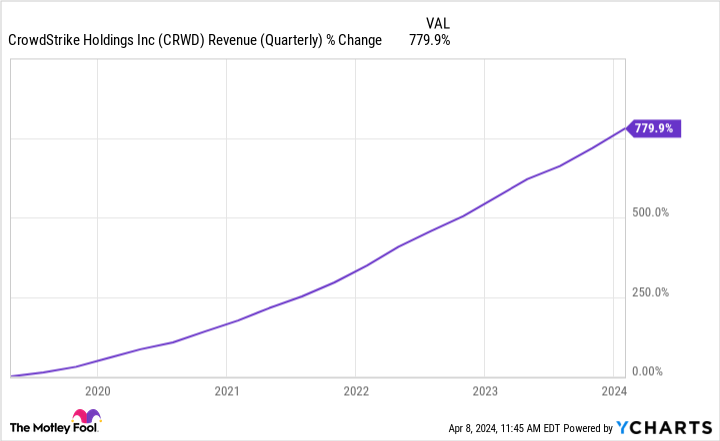

CrowdStrike (NASDAQ: CRWD) is one of the first pure AI cybersecurity companies, having used the technology to automate cybersecurity processes for well over a decade.

Other companies are undoubtedly adding AI capabilities to their cybersecurity platforms, but CrowdStrike has a competitive advantage that should hold strong: data. For AI-based tools to be as effective as possible, they must be trained on tons of data, and “tons” is putting it lightly. CrowdStrike’s head start means it has years’ worth of data that can’t be matched.

Business and financial results highlight just how effective CrowdStrike’s platforms have been. Around 27% of its clients use seven or more of its modules (products in its ecosystem), and 64% use five or more. CrowdStrike’s dollar-based net retention rate was also 119% in the fourth quarter of its fiscal 2024, meaning its established customers spent 19% more with it, on average, than they had in the prior-year period.

According to CrowdStrike and market intelligence firm IDC, the AI-native cybersecurity market is estimated to be around $100 billion this year. By 2028, it’s expected to hit $225 billion. This gives CrowdStrike plenty of opportunity to continue asserting its market dominance and providing good long-term investor value.

3. Taiwan Semiconductor Manufacturing Company

As a semiconductor foundry, Taiwan Semiconductor Manufacturing Company (NYSE: TSM) (TSMC) may not seem like an AI stock, but its importance to the AI ecosystem can’t be overstated.

If AI apps like ChatGPT or other LLMs are the end products of a tree, the semiconductors fabricated by TSMC are the initial seeds. And it all begins with data and data centers. Data centers are vital because they are the only way to store the vast amount of data needed to train AI, and these data centers rely heavily on graphic processing units (GPUs), which function as the brains for computing power.

Before you have functioning GPUs, you need semiconductors, and TSMC is the global leader in fabricating semiconductors. That’s why companies like Nvidia are among TSMC’s biggest customers; they know other semiconductors pale in comparison to TSMC’s, cementing it as the go-to for other major corporations.

Without TSMC’s advanced processes, the AI pipeline would surely take a hit, as it’s likely that progress in the field would be slowed. That reliance alone makes TSMC one of the more important AI-adjacent companies. This domino effect is also expected to make AI-related semiconductors account for a decent portion of TSMC’s revenue (high teens) by 2027.

TSMC is far from the only semiconductor foundry in the AI world, but it’s the most critical.

Where to invest $1,000 right now

When our analyst team has a stock tip, it can pay to listen. After all, the newsletter they have run for two decades, Motley Fool Stock Advisor, has more than tripled the market.*

They just revealed what they believe are the 10 best stocks for investors to buy right now… and Microsoft made the list — but there are 9 other stocks you may be overlooking.

*Stock Advisor returns as of April 8, 2024

Stefon Walters has positions in Apple and Microsoft. The Motley Fool has positions in and recommends Apple, CrowdStrike, Microsoft, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

3 Top AI Stocks Ready for a Bull Run was originally published by The Motley Fool

[ad_2]