[ad_1]

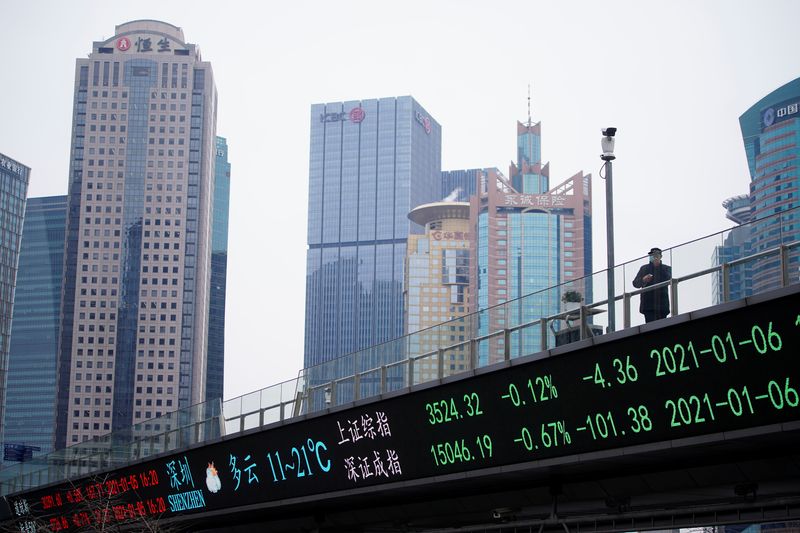

© Reuters. FILE PHOTO: A person sporting a face masks, following the coronavirus illness (COVID-19) outbreak, stands on an overpass with an digital board displaying Shanghai and Shenzhen inventory indexes, on the Lujiazui monetary district in Shanghai, China January 6, 2021

By Dhara Ranasinghe and Koh Gui Qing

NEW YORK/LONDON (Reuters) – World shares slumped on Monday because the rising danger of extra aggressive U.S. and European rate of interest hikes inflicted extra ache on bond markets and pushed the greenback to new 20-year highs, as recession fears mount.

Two-year U.S. yields surged to a excessive of round 3.49%, the very best since late 2007 and much above the 10-year at 3.13%. Yields additionally jumped throughout Europe. [GVD/EUR]

Federal Reserve Chair Jerome Powell mentioned on the Jackson Gap symposium on Friday the Fed would increase charges as excessive as wanted to limit progress, and maintain them there “for a while” to deliver down inflation operating nicely above its 2% goal.

European Central Financial institution board member Isabel Schnabel added to market unease. She warned on Saturday that central banks danger dropping public belief and should act forcefully to curb inflation, even when that drags their economies right into a recession.

Traders waking as much as the truth that charges would stay excessive whilst recession danger grows bought off dangerous belongings. [US/]

The fell to its lowest in a month earlier than recovering by noon to face flat for the day. The was additionally unchanged, and the narrowed losses to be down 0.36%.

European shares fell 0.8% to their lowest in over 5 weeks, and Japan’s blue-chip slid 2.7%.

London markets had been closed for a vacation, whereas MSCI’s world fairness index fell 0.6% to a one-month low.

“The message from Jackson Gap was loud and clear and never what markets had been anticipating,” mentioned Nordea chief analyst Jan von Gerich.

“Central banks want convincing proof that inflation is coming down. That’s dangerous information for the financial system and danger urge for food and raises the danger of a deeper recession if we get extra fast fee hikes.”

Traders ramped up U.S. and euro zone fee hike bets, with markets pricing in a larger likelihood of 75 foundation level hikes from the Fed and ECB in September.

Fed funds futures priced in as excessive as a 73% likelihood the Fed will hike by 75 foundation factors, and charges peaking at 3.75% to 4.0%.

“Markets are specializing in discussing the message of ‘coordinated tightening’ from Jackson Gap as ECB and Fed seem to have re-committed to creating value stability: yields are taking pictures increased and danger belongings are fairly a bit decrease since final week,” mentioned Lars Sparreso Lykke Merklin, senior analyst at Danske Financial institution.

A lot would possibly depend upon what U.S. August payrolls figures present this Friday. Analysts are in search of a reasonable rise of 285,000 following July’s blockbuster 528,000 acquire.

HUNKER DOWN

As traders hunkered down for front-loaded fee hikes, key gauges of fairness market volatility shot up.

The , broadly dubbed Wall Avenue’s worry index, rose to its highest since mid-July. The euro STOXX volatility index, the European equal, jumped to its highest degree in six weeks.

“Chair Powell and the Fed make it crystal clear that their job combating inflation stays unfinished,” researchers at Morgan Stanley (NYSE:) mentioned in a notice to shoppers. “The trail for shares from right here can be decided by earnings, the place we nonetheless see materials draw back.”

The aggressive refrain from central banks lifted short-term yields globally, whereas additional inverting the Treasury curve as traders priced in an eventual financial downturn. [US/]

This all benefited the safe-haven greenback, which briefly shot to a contemporary two-decade peak at 109.48 in opposition to a basket of main currencies.

The greenback hit a five-week excessive on the yen and was final up 0.8% at 138.72, with bulls seeking to re-test its July high of 139.38.

Sterling sank to a 2-1/2-year low round $1.1649 as Goldman Sachs (NYSE:) warned Britain was heading for recession. The euro dropped to as little as $0.99145, not removed from final week’s two-decade trough of $0.99005, however was final up 0.44% at $1.0006

The Dutch September fuel supply contract dropped as a lot as 11% as Germany’s financial system minister mentioned he anticipated costs to fall quickly as Germany is making progress on its storage targets, with amenities practically 83% full and set to hit its 85% Oct. 1 aim in early September.

Provide fears pushed in Europe 38% increased final week, including additional gas to the inflation bonfire as a three-day halt to Russian pure fuel provides by way of its fundamental pipeline to Europe will begin on Wednesday. [NG/EU]

German benchmark energy costs, in the meantime, breached 1,000 euros per megawatt hour for the primary time on Monday.

“I battle to know the sense of sharp (ECB) rate of interest hikes. The massive downside is vitality provide, and proper now it would not look we will get out any time quickly,” mentioned Carlo Franchini, head of institutional shoppers at Banca Ifigest in Milan.

“Such a pointy rise in such a sophisticated financial image will put corporations and households in a really troublesome scenario. Buying and selling volumes are actually skinny. I feel it might be price promote into any rally though the phrase rally would not appear applicable.”

The rise of the greenback and yields has depressed gold, which was final flat at $1,737.45 an oz.. [GOL/]

Oil costs swung increased on hypothesis OPEC+ may reduce output at a Sept. 5 assembly. just lately rose 3.6% to $96.36 per barrel and was at $104.15, up 3% on the day.

GRAPHIC: Greenback index at 20-year highs, yields soar (https://fingfx.thomsonreuters.com/gfx/mkt/lgpdwyrwmvo/greenback.PNG)

[ad_2]